En español, en français, em português.

We are launching a new booking engine feature that will help you provide a better service to your customers, optimise your direct channel conversion and capture more direct bookings, both online and by phone, WhatsApp, SMS or email.

With “Book, Think & Pay” (BTP), you can give your customers a period of time (which you determine), after the booking, to provide their credit card details as a guarantee for “pay at hotel” rates, or to make the payment straight away with “pay now” rates through the payment gateway you have on your website.

“Book, Think & Pay” is clearly useful for telephone, WhatsApp or SMS channels, whether you manage these bookings directly from reception or work with a Mirai Omnichannel contact centre company. For this type of booking, “Book, Think & Pay” allows you to:

- Avoid asking for the customer’s credit card number, especially for those who feel uncomfortable providing this information over the phone. They will then receive a secure payment link through which to confirm the booking. In addition, they will receive this email from your hotel’s email address (if your booking delivery is set up properly via Amazon-SES) and not from one of those no-reply@ addresses, which tend to generate insecurity due to the very high level of fraud and phishing these days.

- Increase conversion, as customers will make the payment themselves, overcoming possible double verification processes (SMS or biometric fingerprint) and minimising the risk of rejection by the banking platform, as the transaction is made from the customer’s usual browser in their country of residence.

- Eliminate risks for you and the customer, as the transaction will take place in a secure and confidential environment.

Another possible use case would be in online sales on your website, where “Book, Think & Pay” will help you improve the conversion of customers who have come very close to booking but, when they reached the final step, didn’t do it because:

- They need some hours to make the final decision and complete the booking.

- They do not have their card with them at that time.

- There is a problem with the payment (double authentication, international payment restrictions) and the gateway denies the payment.

- They are uncomfortable doing this on their mobile device and prefer to wait until they are on a desktop computer.

How “Book, Think & Pay” works: no operational burden for you

Your time is worth money and at Mirai the last thing we want is manual processes. That’s why we have designed “Book, Think & Pay”, so that everything works 100% automatically. Let your booking engine work for you.

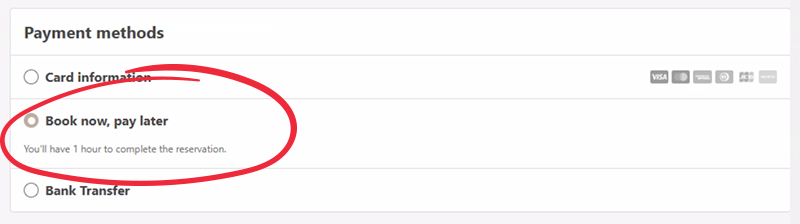

1.If the requirements you have set are met, the guest (or contact centre agent) will see the option to “complete the guarantee or payment in the next X hours”, along with the usual options to do it on the spot.

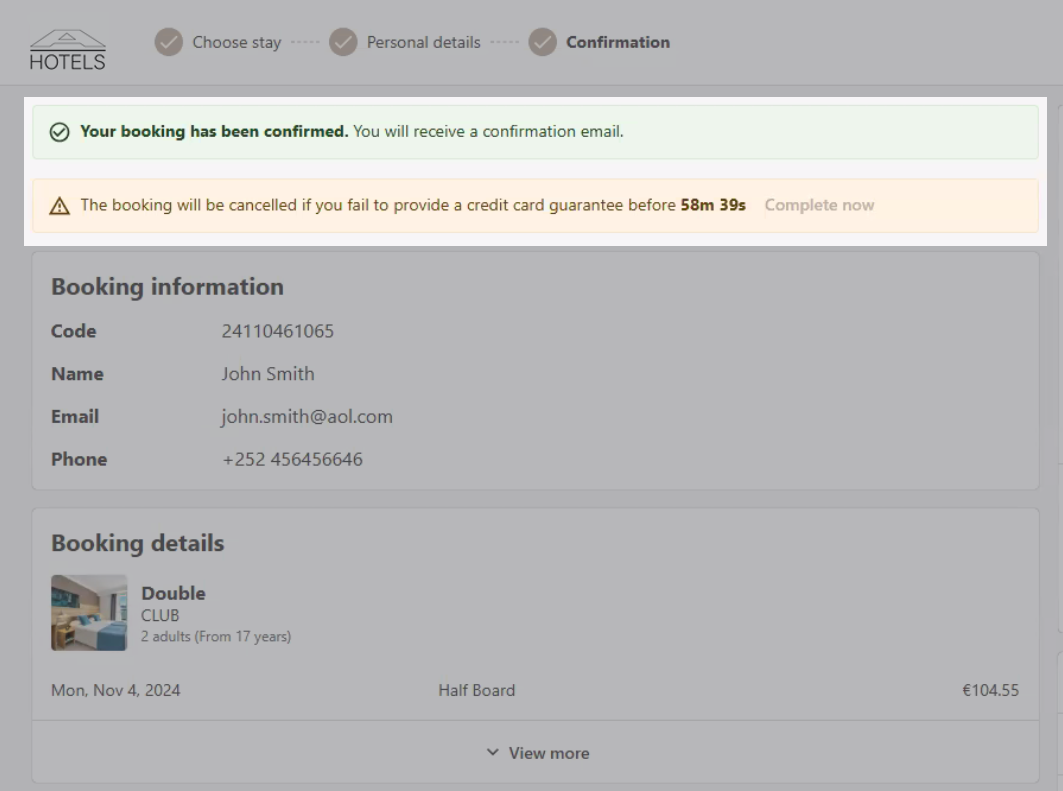

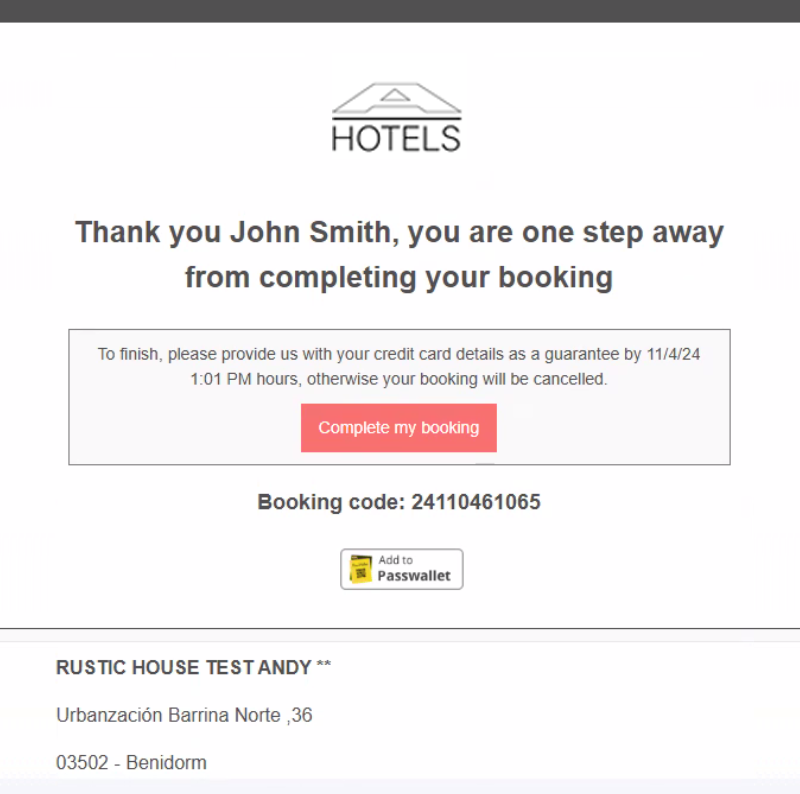

2.Customers making use of this option will receive a temporarily confirmed booking marked as “pending payment or guarantee by card”.

3.Then, the guest can complete the payment at three points: the booking confirmation, from the confirmation email and, lastly, from the “My booking” link on your website.

4.They will be able to pay (if you have a payment platform or payment gateway connected) or enter their card details as a guarantee.

-If they do so, the booking will be changed from “pending payment” to “confirmed”.

-If the client does not make the payment or provide the guarantee within the deadline you have given, the reservation will be automatically cancelled.

-In either case, we will send an email to both the client and the hotel to inform them of the booking or cancellation.

-In case of cancellation, we will replenish the inventory in your PMS and other channels through the channel manager. If you do not have a channel manager, you will have to replenish the inventory manually as with any cancellation.

-If the customer tries to pay after the deadline, we will explain that this is no longer possible because the deadline has passed.

5.In addition, the guest always has the chance to call the hotel or for the hotel to contact the guest and execute the payment by offline means. In this case, there is the possibility to register that the payment has been made on the extranet to avoid the booking being automatically cancelled.

Booking without a card? How many end up making the payment?

Of course, there are always customers who do not complete the payment and the booking is automatically cancelled. The main reasons are that they simply changed their mind or that they forgot and the deadline passed. Our numbers tell us that up to 75% of guests do end up paying, while 25% do not. Keep in mind, however, that these are mostly incremental bookings, as the customer always has the option to enter the card at the time of booking and for some reason fails to do so.

Maximum flexibility for you to decide when to offer it to your customers (and when not to offer it to them)

We have provided you the highest possible flexibility to configure “Book, Think & Pay” to your taste and according to your operational needs.

Start by configuring the hours you want to give the customer to complete the payment (e.g. 24h or 48h). Don’t worry; in the case of same-day bookings, or when they already incur a cancellation penalty, the payment deadline is reduced to one hour.

Restrict the “Book, Think & Pay” functionality according to your needs:

- By type of direct sale: telephone bookings (contact centre or at reception), SMS or WhatsApp, Facebook or open it to everyone including online bookings through your website.

- Depending on the booking window: if you don’t want to commit your inventory to bookings with entry today or tomorrow, you can easily set it up.

- By fare type: Do you want to restrict it only to certain fares such as “pay now” or “non-refundable”? No problem.

- By issuing market or device type: if your need is more focused on specific source markets, or you want to restrict it to mobile only, you are free to define it this way.

Compatible with your payment platform, whichever it may be

Another great advantage of “Book, Think & Pay” is that the customer will use the same payment platform that you have set up for prepaid online bookings. There is no need for a third-party solution and no need to contract an additional payment platform with the operational costs that this entails. You will receive the amount of the booking in your account as if it were a conventional online booking.

I want to activate “Book, Think & Pay”, what do I have to do?

Contact your account manager and they will help you set it up and answer any questions you may have.