En español, en français, em português.

Last June we discussed the winners and losers of the DMA or Digital Markets Act in Europe based on our own metasearch tracking data of more than 3,000 properties worldwide.

Trying to shed some more light on this complex issue of “the impact of the DMA for hotels”, we expanded our research to:

- Analyze the attribution of all bookings and not only those coming from metasearch.

- To do so, we had to go beyond our own metasearch integration tracking data and switched to Google Analytics 4 as our data source instead.

- As a consequence, we used the new Google Analytics 4 data-driven attribution model, quite different from other models such as last click and first click.

- Expanded the timeframe from 4 to 8 months before/and after the DMA (Jan. 19 2024).

What we did not change was the 3,000+ properties as the perimeter of our analysis. Additionally, it’s important to point out that not all these properties invest in Google Ads, Hotel Ads or other metasearch players. What we are trying to measure is the % of traffic shifted not that much the absolute numbers.

Despite the adjustments in the analysis methodology the conclusions remain in line with our previous analyses.

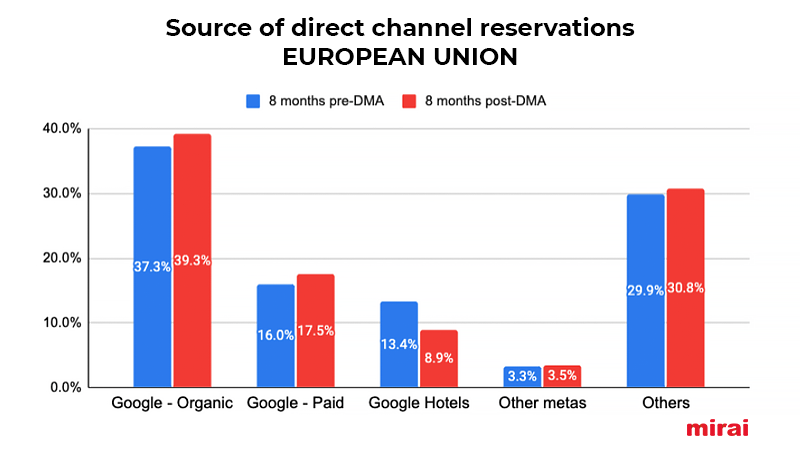

- The tragedy continues for Google Hotels within the European Union, sinking its share as a “source of reservations” from 13.4% to 8.9% (-4.5% in absolute numbers).

- The final picture for Google (combining Ads, Google Hotels and organic search) is a net 1.5% loss, although it still remains the leading source of direct bookings with a solid 65.7% share.

- The good news for hotels is that they managed to capture back 82% of that loss

– 3.5% through other Google’s placements, more specifically 1.5% from paid traffic (mostly Google Ads) and 2.0% from organic search.

– A 0.2% increase in direct booking contribution by other metasearch players such as Trivago and Tripadvisor, up to 3.5%.

- The net effect in direct reservations for the hotels would be -0.8% (4.5% – 1.5% – 2.0% – 0.2%), in line with our previous analyses. It does not seem like a huge impact, especially in a record year for many hotels in Europe, but it is a negative number nonetheless.

- This loss of direct revenue does not necessarily mean a loss in reservations for hotels, as OTAs are probably gaining this traffic and bookings. Unfortunately, for hotels that means a higher distribution cost due to channel shift from direct B2C sales to intermediated (OTA) sales.

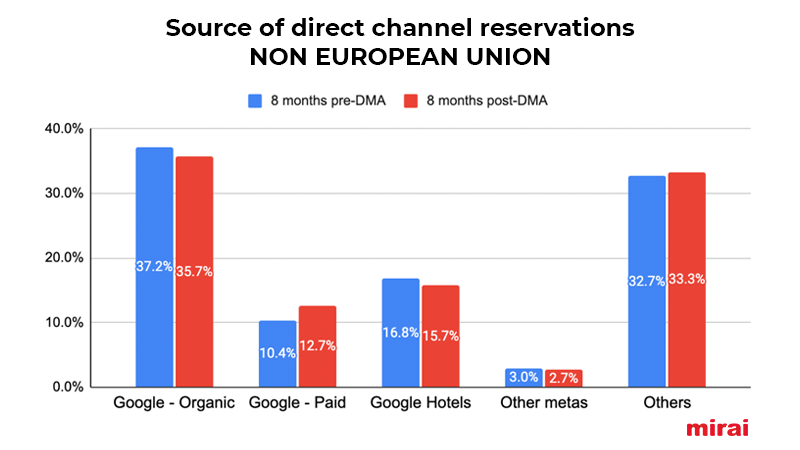

Upon conducting the aforementioned analysis in Non European markets, the numbers reveal a very different reality:

- Google Hotel Ads loses some share, yet a fraction when comparing with the EU situation. Google Hotel remains as a key source of bookings for hotels reinforcing the importance of showing your direct rates there ideally with the best price compared to OTAs.

- Paid traffic increased significantly growing 20% up to 12.7% of the total generated bookings. Organic traffic slightly decreases and loses some share.

- Overall, Google ecosystem remains pretty flat (-0.29%), although with a higher proportion of paid which translates into higher hotel costs. Clearly a bad effect for hotels.

- Other metasearch lost 10% to 2.7%.

Conclusion

Based on our ongoing analyses since the DMA was rolled out it is clear that the DMA is having a significant impact in the way users (demand) interact with hotels (supply) through Google, the leading search engine in the EU.

Within the Google ecosystem Hotel Ads is taking the most severe impact, decreasing its relative share by -33%. Even though the numbers show that a portion of the lost visibility is recouped by other google solutions (organic & paid) the net effect of the DMA is that the OTAs are getting an increase of visibility within Google which undeniably results in more business captured by the OTA increasing the hotels costs and their dependency on third party distribution. Was this outcome the intended outcome of the EU regulators? Certainly not.

In any case, the DMA case is far from over and we will most likely see further changes in the distribution arena. As we reported on our post update in late May, the EU ratified Booking.com´s gatekeeper self designation on May 13th. As a result Booking.com should be DMA compliant by November 13th, we have already seen fundamental changes in Booking.com´s business practices like the full removal of the parity clause in EU markets announced on June 25 th and applied across all of their contracts on July 1st.