After a few days of coming to terms with the tragic attacks which took place in Barcelona and Cambrils, we have analysed the behaviour of more than 8,000 bookings made in Barcelona during the weeks prior to it and, in particular, during the week after the attacks and compared them with the same period in 2016. It’s not easy to talk about numbers in difficult times like these, when the most important thing is human life.

We would also like to clarify that, usually, late July and August are weeks with low numbers of bookings. In spite of that, these are the results:

- There has been a considerable decrease in the pick-up. If the four weeks before the attacks saw the pick-up rise to 11% in comparison with the same period the year before, the week of the 17-23 of August saw it go down by 19%.

- The most resistant sector is the MICE (Meetings, Incentives, Conferencing, Exhibitions) sector at the expense of the tourism sector, which is the one that suffers the most, particularly tourism with children.

- The markets most affected by the attack were the British (which has also suffered from the decline of the British Pound by 8% in the last four months), French, Asian, Italian and the Spanish. Strangely enough, the American market, despite having considerably slowed down its growth, is up in comparison to last year.

- Low effect on cancellations. There were barely any cancellations and the rate followed the same trend as the four weeks prior (ranging from 20.4% to 20.9%). Once again, the cancellations were made mostly by tourists (with children, in particular) than other client types.

- There was no price variation either, growing just by 0.4%, staying at 10% on the books (OTB) until the end of the year, although this data should be analysed per month of stay and not by booking date. This number could also be due to the usual fear of hotels to receive cancellations (to book again if the price goes down) or simply to the caution of waiting to know the impact on the demand.

- In the short term, this negative effect will be softened by the high volume of bookings expected, made previously, which have not been cancelled.

Bookings made the week after the terrorist attacks, depending on time of stay:

Stays from 17-31 August: sharp drop in pick-up and price

We are dealing with very last-minute bookings made on a very high previous occupancy base. Therefore, the final impact is expected to be minimal.

- Pick-up: As expected, the biggest drop was for the last fortnight of August, by a total of 30%. Fear put the brakes on all last-minute bookings. Safety is a prime factor when choosing a destination.

- Average price: Average drop of 14% in comparison to previous weeks, despite maintaining an OTB of 16% above last year’s. The European Society of Cardiology Congress from 26-30 August and the PokerStars Championship until the 27th of August have undoubtedly helped to maintain a high price.

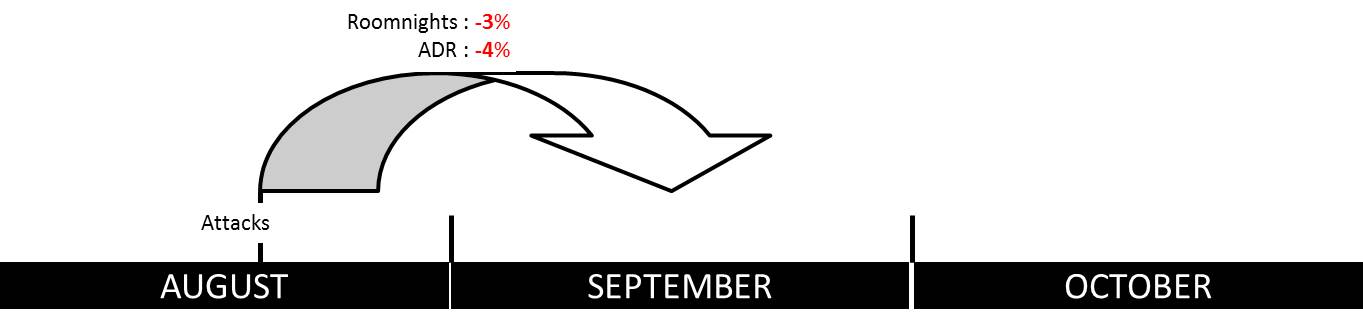

Stays in September: good prospects maintained

- Pick-up: Reduced by barely 3% in comparison to the same week in 2016, although it had grown by 21% in the previous four weeks. This September will bring plenty of MICE events (when the impact is always lower) which seems to be holding up the pick-up.

- Average price: Slight drop of 4% in comparison to the price published during previous weeks, although it still maintains a healthy 16% of OTB, an increase of 9% in comparison to 2016. For September, hotels already had a high level of occupancy together with fewer cancellations than expected, which combined to help maintain high prices (at least for now).

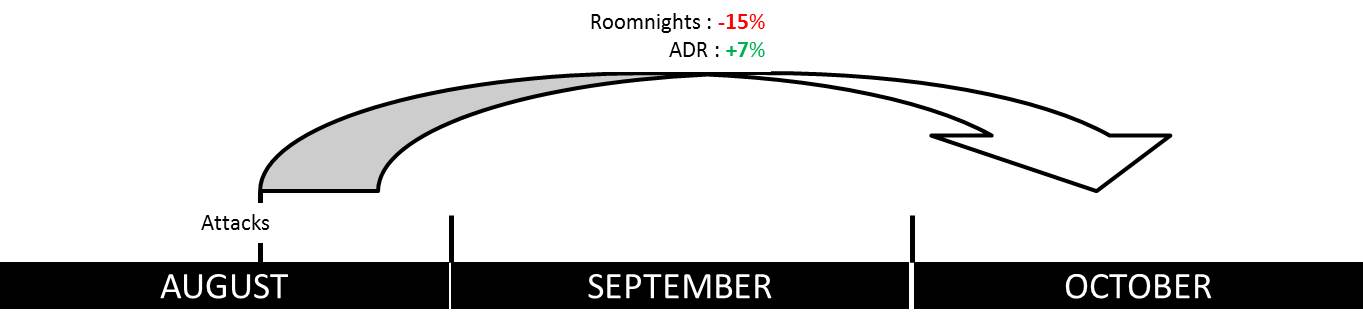

Stays in October: caution ahead of a traditionally good month in Barcelona

- Pick-up: Dropped by 15% in comparison to the same week in 2016, a considerable decrease if we take into account that, during the four weeks prior to the attacks, we had registered a 13% increase. It seems that many of those who were planning a trip in October have postponed it. The corporate and MICE sectors, however, still maintained a good rhythm.

- Average price: A surprising rise of 7% in comparison to the four weeks prior, together with a solid 10% increase on the books, which shows that the hoteliers in Barcelona are confident of October being a good month and are committed to maintaining a high price despite the drop in pick-up (which we hope is temporary).

It is still too early to draw conclusions but we hope that the initial fear will disappear in the upcoming weeks and that Barcelona will once again be one of the most visited cities in Europe. The city has shown not to have any fear and is ready to continue welcoming clients from all over the world. The low rate of cancellations at the moment is a cause for optimism despite that almost all of the winter stock is still unsold.