En español, en français, em português.

Google launched free booking links on March 9th to complement the existing Google Hotel Ads program. It was the company’s biggest move in recent times and generated an endless debate about where Google is heading in the online travel ecosystem.

Eight weeks later, the dust has settled, and we are finally able to evaluate performance based on a variable previously unavailable: data. We dove into the impact of free booking links (‘unpaid’) comparing the 8 weeks since the launch (Mar 9 – May 4) to the previous 8 weeks (Jan 12 – Mar 9).

The areas of study and executive summary are:

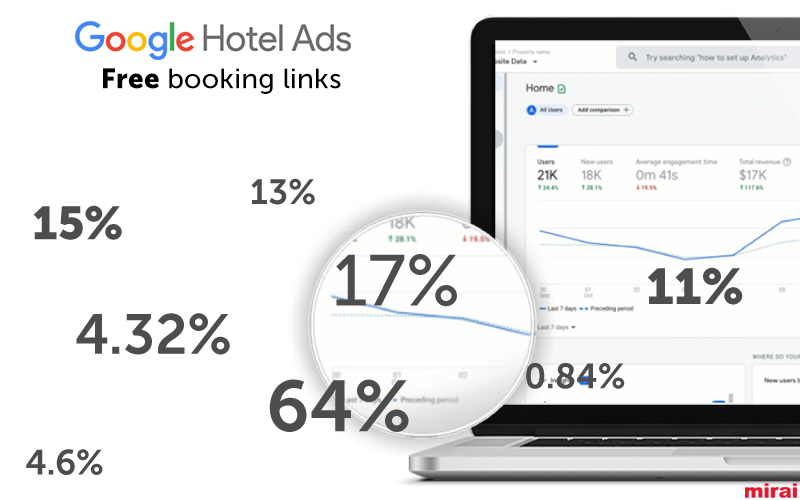

- The share of free booking links (hereafter FBL, for the purpose of this post) averages 17% in clicks and 11% in sales.

- There is no difference between paid and unpaid in terms of hotel KPIs such as “average daily rate”, “length of stay” and “average booking value”.

- Conversion rate of paid campaigns is 64% higher than that of FBL.

- FBL adds 0.84% to 4.32% incremental direct-channel revenue to hotels.

- Three is no relevant impact on impression share of paid campaigns, thus far.

Without further ado, let’s start.

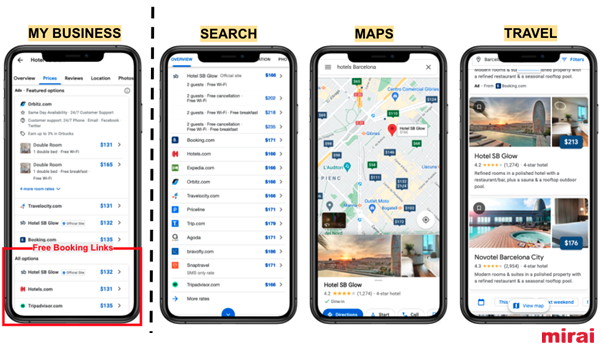

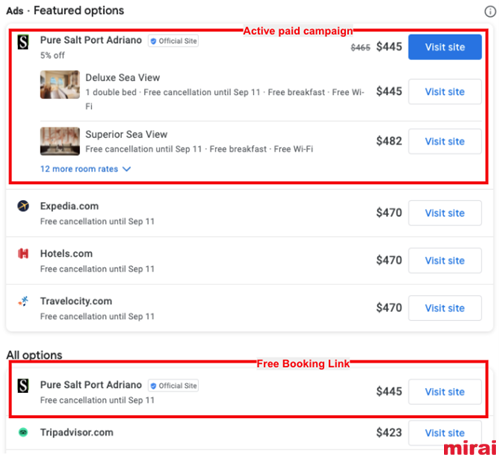

Some context first: free booking links placements

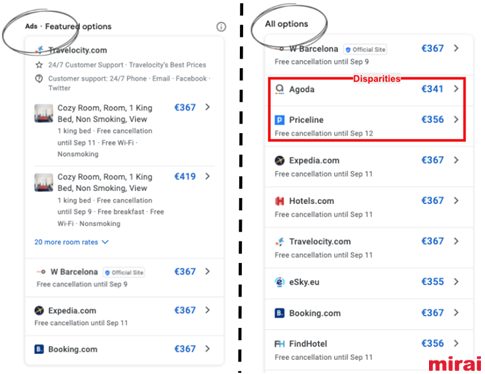

It is important to point out that FBLs are only present in the My Business (travel) hotel site and not in other popular Google Hotel Ads placements such as search, maps and the rest of travel.

Update March 2022: Google has announced increased visibility of free booking links, including them on the search engine results page as well as on Google Maps.

As Google explains in its documentation, Hotel Ads only breaks down its metrics into two categories but, unfortunately, placement is not one of them.

- Natural Search or localuniversal: The user found the ad or free booking link through a search, typically by searching on google.com.

- Map search or mapresults: The user found the hotel booking link through maps.google.com.

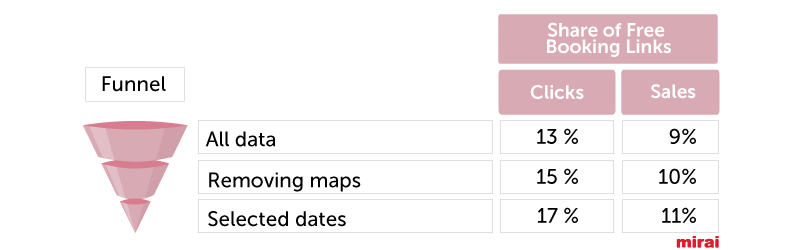

Therefore, if we use all available data we would not be comparing “apples to apples” as FBLs do not show up in maps or search results. To get around this problem and “isolate” the My Business data, we defined three different scenarios as steps in a funnel from top to bottom.

- All aggregated data, combining all placements.

- Removing “maps” placement, as Google clearly identifies data from maps in its metrics.

- Only users who chose specific dates (selected dates), removing those who stayed with the default dates Google selects for you. These users are supposed to be “lower in the funnel” and, therefore, more likely to land in the My Business site.

Free booking links share of clicks & sales averages 17% and 11% respectively

Although we needed a number to reach a conclusion, the reality is that the share of FBLs depends on where in the funnel the user resides. These 17% and 11% more closely represent the “apples to apples” scenario that we previously called “selected dates”. However, the higher in the funnel the lower the percentage of share captured.

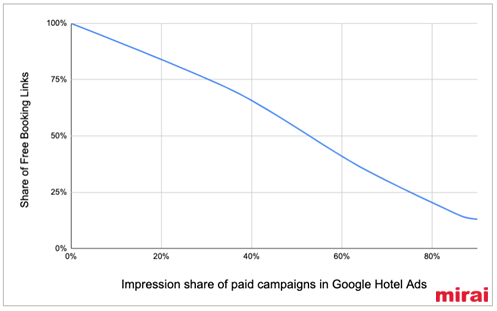

Another important conclusion is that the share of FBLs clicks significantly depends on the existing paid campaigns’ impression share (the percentage of impressions that your ads receive compared to the total number of impressions that your ads could get). And that makes a lot of sense.

- The less visibility the paid campaigns have, the higher the share of FBLs. At one end, hotels that did not have any paid campaigns reported a 100% FBLs share.

- Hotels with a very high impression share of their paid ads had lower FBLs share. At the other end, hotels with close to 100% impression share had the lowest FBLs share (13%).

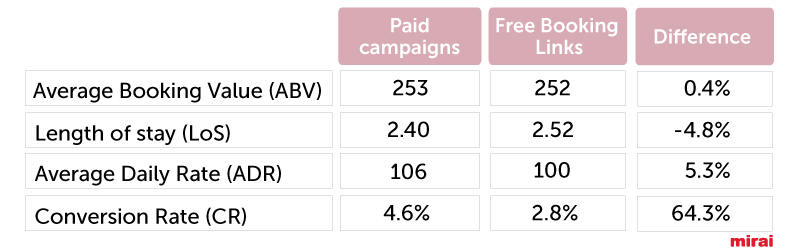

Hotel Ads paid campaigns convert 64% more clicks into reservations than FBLs

Before comparing KPIs such as “average daily rate” or “conversion rate”, we first had to scrub the data and identify the situations where the user was presented with both options: the paid ad and the free booking link.

Otherwise, numbers would be biased towards those hotels where FBLs had a higher share (because paid links were not present) and would hinder the real benchmark. We picked hotels and markets where the impression share exceeded 90%, guaranteeing that the user was presented with both links most of the time. The data unveils some expected results and an interesting surprise.

- No relevant differences in the “average daily rate”, “length of stay” and “average booking value”, which we would say makes a lot of sense.

- Paid campaigns conversion rate was 64% higher than free booking links. In some markets, such as the US, we saw even bigger differences. Some potential reasons paid campaigns performed better than FBLs:

- Prime location above-the-fold of paid campaigns compared to unpaid.

- More and better information presented traditionally tends to ease conversions. Information such as cancellation policy, meal plan and key services such as wifi are present in paid links, but not the unpaid ones.

- More attractive look & feel with photos of the rooms.

- Given that there are only 4 paid placements, as opposed to a much higher number in the unpaid section, paid placement has a lower impact on OTAs undercutting the direct. In other words, the chance of an OTA undercutting a hotel is much higher in the “all options” section.

Free booking links sales are incremental

Out of all questions, probably the most interesting one is to what extent FBLs represent new sales or actually cannibalise existing sales from paid campaigns.

Our first approach was to focus on hotels that did not have an active paid campaign at the time FBLs were launched. These hotels are very representative as they, obviously, did not have any clicks or sales from Hotel Ads. All sales came from FBLs and, therefore, the analysis was very simple and insightful. With this group of hotels, our numbers show that:

- 28% of hotels got at least one booking from FBL, averaging an increase of 11.1% in sales.

- However, to be statistically fair, we have to consider all hotels and not only those that received bookings. Considering all of them, FBL averaged an increase of 4.32% in sales.

Can we consider these additional sales as incremental? We feel comfortable in saying that we can, as there were no previous paid campaigns. We should point out, however, that we are talking about “incremental sales in the direct channel” and not “incremental total revenue”. In other words, we are saying that every new booking coming from FBL is one less booking coming from an OTA.

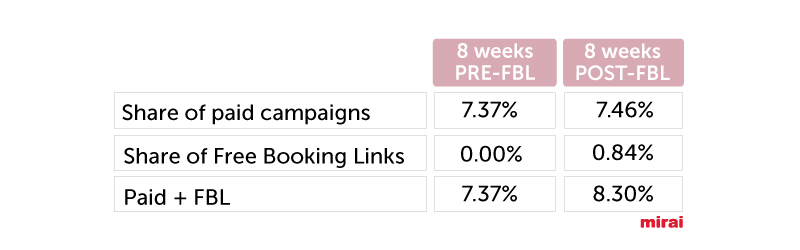

The second group of hotels that we analyzed were those that already had an active campaign in Hotel Ads. In these hotels starting March 9th, users were presented with two options to choose the same direct channel (paid and unpaid).

We measured the share of sales coming from paid Google Hotel Ads campaigns before and after the launch of FBL. We then added those results to the share of FBL to get a combined total.

- Share of paid campaigns remained the same.

- FBL added an average of 0.84% sales.

- Whether there is cannibalisation or not, it is impossible to say. However, that question is less relevant since the sum of paid and unpaid is higher after the launch of FBLs.

How do we reconcile the difference between 0.84% and 4.32% incrementality?

- For hotels that did not have any campaign, FBLs mean incremental visibility in a placement they otherwise had none. On the contrary, for hotels that did have a paid campaign, FBLs “only” meant slightly more visibility with a second entry in the results. It makes sense the incrementality is much lower than in the first group of hotels.

- In this second group, FBLs seem to act as a “cushion” or “safety net” for those times where they lost the bid and fell out of the paid section.

A sanity check that would reconcile both numbers could be the following: Let’s assume a hotel loses the bid and is excluded from the paid positions 20% of the time. On these occasions, FBLs represent the same incremental 4.32% in sales. If we multiply both numbers (20% x 4.32% = 0.86%) we get a very similar number to the 0.84% above.

So far, there is no apparent negative impact on Impression Share of existing campaigns

We had expected to see an impact on the impression share of the existing paid Hotel Ads campaigns. However, we have yet to see one. It actually increased by 1.3%. We broke down the data by source market, but saw no significant differences there either. This unexpected outcome may have been caused by:

- Not comparing “apples to apples”, as we are using two different periods of the same year and seasonality might be playing a role. In addition, we are in the middle of a pandemic, and demand was much higher in the last 8 weeks than in the previous ones.

- Decreasing cancellation rates. From the beginning of this pandemic, many hotels that were running CPC (cost per click) campaigns moved to Commission per Stay campaigns. In this commission model, cancellation rates impact the impression share. The lower the cancellation rate, the better it is for hotels as the equivalent CPC is higher. Cancellation rates in the last three months, even being high compared to pre-covid times, were significantly lower than the previous months.

- It might be too early to see moves by OTAs to increase their bids, something that would put pressure on the bid rates by making them more competitive. This is just a hypothesis, as we do not yet have supporting data. Should we expect an increase in average CPCs? We would say so, although we do not see any evidence in this direction yet. Time will tell.

Conclusions

The introduction of free booking links was a major move by Google and a potential shake-up of the current meta ecosystem, giving the direct channel more options to compete with OTAs. Eight weeks is not much time, but it is enough to make some conclusions based on real data and not just opinions.

If you want to go deeper into this topic, you can see the interview of Trevor Grant, from Revenue Hub, with Pablo Delgado, CEO of Mirai, on this video :

For those who are active in FBLs, we’d recommend each of you track down your own numbers. Check your Google Analytics to come to your own conclusions. If you don’t have the data, ask your integration partner for it. At Mirai we tag the FBLs differently so that you can easily differentiate the traffic in Google Analytics and measure its impact.

For those hotels that are not present in FBLs yet, contact a Google Integration partner so you can benefit from this free, incremental visibility and traffic. At Mirai, we can help you onboard your property to Google Hotel Ads and FBLs, even if you are not using our booking engine.

To learn more about how to boost your direct channel in metasearch click here or contact metasales@mirai.com