En español, en français, em português.

Artificial Intelligence (AI) has profoundly transformed how users consume content online. With its ability to interpret natural language and capture emotions, AI delivers more concise, empathetic, and personalized responses than traditional search engines. Features like the ability to refine searches seamlessly, coupled with voice recognition in multiple languages and generative AI capabilities, have expanded content formats beyond text to include images and videos, unlocking new and unprecedented possibilities.

A multi billion industry dominated by just a few giants

The travel and hospitality sector, a $5 trillion industry, allocates a significant portion of its revenue –about 7%- to digital marketing. The dominant players, Booking.com and Expedia, invest between 30% and 50% of their revenues in marketing, totaling a staggering $16 billion in 2024. In contrast, suppliers, such as hotels, invest a modest 2% to 5% in marketing efforts. We wrote a blog post related to this huge difference in investment between hotels and OTAs.

This enormous marketing expenditure flows primarily to a handful of platforms:

- Search Engines: an industry largely controlled by Google.

- Social and Video Platforms: led by Meta (Instagram and Facebook), TikTok, YouTube, and Pinterest.

- Metasearch Engines: Google Hotels dominates, followed by TripAdvisor and trivago.

- Marketing in OTAs: including Expedia Travel Ads, TripAdvisor Sponsored Placements, and similar offerings.

Newcomers aiming to disrupt the landscape

The emergence of AI platforms like ChatGPT, Perplexity, Llama (Meta), Claude, Microsoft’s Copilot, and countless others represents a potential shift in consumer behavior. While dethroning established giants like Google may seem daunting, history -with examples like Kodak, Nokia, and Blackberry- shows that consumer preferences can pivot swiftly when novel alternatives emerge.

ChatGPT, for instance, has already amassed nearly 200 million monthly users and over 100 million app downloads in just over a year. While these figures are still dwarfed by Google’s 80 billion monthly users, ChatGPT’s awareness -currently at 18% among U.S. adults- is expected to grow globally.

Despite the opportunities, the high cost of AI development presents significant barriers to entry. With estimated costs of $100 million to create a new AI model and AI specialists being among the highest-paid in the tech industry, only companies with deep pockets- like Apple, Amazon, and Microsoftare well-positioned to compete. However, smaller companies leveraging third-party AI models or niche applications may carve out valuable market space, though many are likely to fail in the process.

Rising costs and the need for revenue models

As AI costs escalate, finding sustainable revenue streams becomes critical. In 2024, OpenAI incurred losses of $5 billion, and Perplexity’s revenue barely reached $25 million. Meanwhile, Nvidia’s stock surge reflects the intense investment still pouring into AI.

To offset rising expenses, many AI companies, such as OpenAI (chatGPT) and Google (Gemini), have introduced subscription models, paid memberships, and APIs for enterprise use. While these strategies generate revenue, it remains unclear whether they can keep pace with the rapidly increasing costs of AI development and maintenance.

Will paid advertising dominate AI platforms?

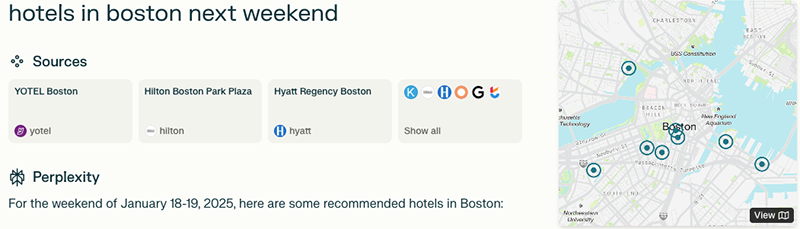

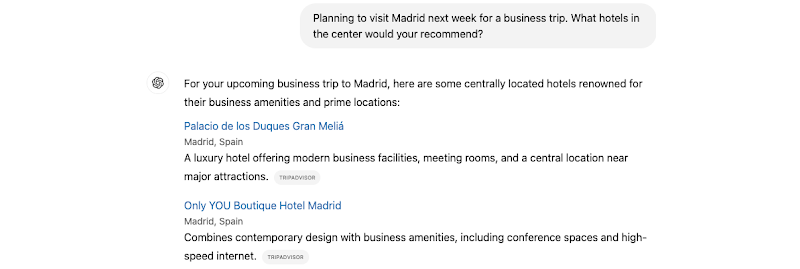

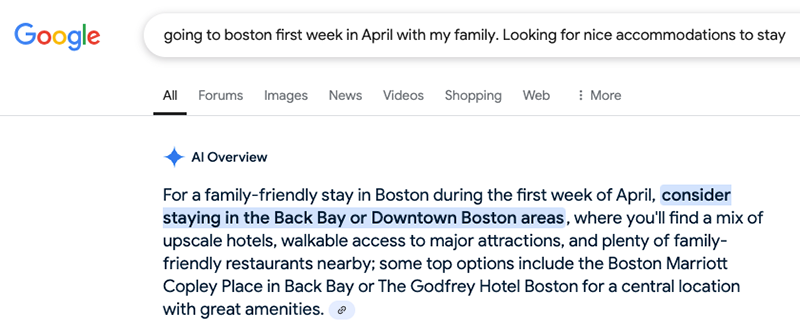

Currently, many AI platforms include organic links to sources together and the ability to place results in a map, helping users delve deeper into topics.

For instance, Perplexity offers “Spaces”, where marketers can request their sites to be indexed. ChatGPT does not offer such a feature and combines Bing’s search index with its proprietary AI to provide links and citations in its results. So far, these links are unpaid.

However, as AI platforms seek profitability, the introduction of paid advertising seems inevitable. AI could replicate the pay-per-click model that has proven immensely successful for search engines. Actually chatGPT says the following when asked about adding links to its results:

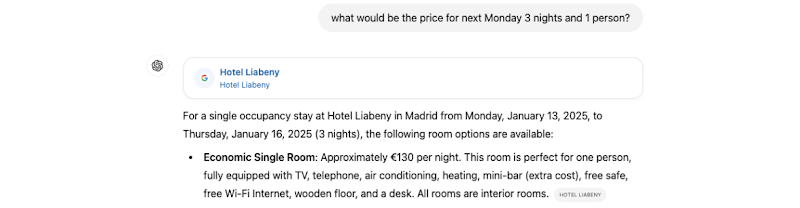

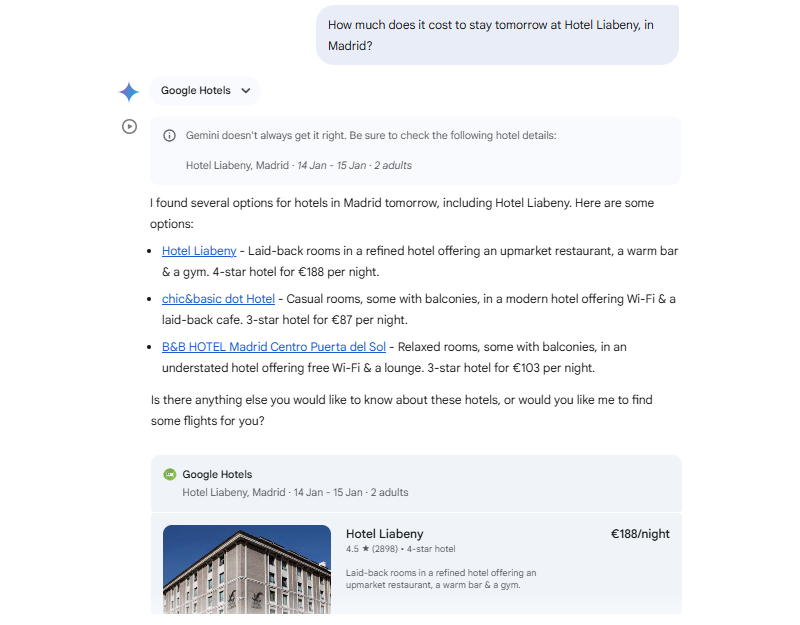

This transition may significantly impact hospitality marketing, especially given the industry’s unique challenges, such as constantly fluctuating availability, rates, and inventory (ARI). As of today, AI only shows estimates of prices but that will change as we speak.

Integrating real-time ARI, just as metasearch did a decade ago, is likely the next frontier, enabling seamless booking links embedded in AI-generated results. Gemini (Google) has the ability to show real time ARI leaning in its metasearch solution Google Hotels and deeplink to the Ad behind that price.

Existing players will not stand still

Major players are already adapting. Google, despite losing its first-mover advantage, has launched Gemini, its AI-driven product, integrating it into its ecosystem to maintain relevance. While this approach may cannibalize clicks from Google Ads, it’s a necessary move to compete with AI platforms like ChatGPT.

In the OTA space, Booking.com and Expedia have begun incorporating AI into their web solutions and mobile apps. With unparalleled expertise in travel and consumer behavior, vast amounts of data, and substantial budgets, these companies are poised to make significant strides. However, even for these giants, AI’s high costs could strain profit margins in the short term.

Conclusion

AI is poised to disrupt the hospitality industry’s marketing landscape, creating new opportunities for hoteliers and newcomers while challenging the dominance of existing players. Hotels that proactively adapt and invest in understanding AI’s potential will be better equipped to compete. Conversely, those who fail to act risk losing ground to OTAs and other innovators.

Will ChatGPT, Perplexity and similar platforms establish themselves as new global leaders? Can startups leverage AI to disrupt the status quo? Or will established giants like Google, Booking.com, and Expedia consolidate their dominance by integrating AI into their offerings? The answers remain uncertain, but one thing is clear: the race has just begun, and the hospitality industry is on the brink of transformation.