They are the current hot topic of the industry: constant advertising on television, astronomical acquisitions of Kayak and Trivago, they occupy most part of the news in specialised media… They have been with us for a few years although they have only recently started to experience a boom. Why so much prominence? Are they just a trend? What role are they destined to play in the increasingly-complex hotel distribution? And, above all, how will this affect the hoteliers on a daily basis? The answer is that it depends on the attitude of each hotelier. It is easy and feasible for them to become an opportunity with this small guide.

They are the current hot topic of the industry: constant advertising on television, astronomical acquisitions of Kayak and Trivago, they occupy most part of the news in specialised media… They have been with us for a few years although they have only recently started to experience a boom. Why so much prominence? Are they just a trend? What role are they destined to play in the increasingly-complex hotel distribution? And, above all, how will this affect the hoteliers on a daily basis? The answer is that it depends on the attitude of each hotelier. It is easy and feasible for them to become an opportunity with this small guide.

Three client motivations…

The hotelier, in his everyday practice, does not have direct contact with the metasearch engines. The contracts are made with intermediaries, with whom he agrees a price and sells the hotel; on the other hand, he also maintains the official website as another distribution channel. This commercialisation view as management of sales channels is perhaps not the most adequate to analyse the success of the metasearch websites.

In the everyday reality of many hoteliers, metasearch websites do not exist. Traditionally, they receive the commercialisation from the distributors that work for them. From that viewpoint, their biggest decisions are based on choosing their intermediaries well; their management focuses on the prices that they sell to them and their measure of success or failure is the compared amount of bookings of each of them in relation to their costs (or margin).

It is a dangerous isolation that had never been as serious as it is now.

A more useful approach would be to understand the origin behind every booking, the client’s motivations and his process of decision and purchase. When raising this point, three big names come to the fore: Google, Tripadvisor and Trivago, all of whom have hit the nail on the head covering these needs:

1. The client needs searches, maps, photos… information to begin the process, showcases. This is Google’s strong point. Their results page is one of the key spots where it is make or break for your hotel.

2. The client searches for reviews and there is no self-respecting hotel website that does not include them. Tripadvisor is the king of reviews.

3. The client needs availability and prices; prices not just to compare hotels but also to compare the different channels that the chosen hotel can be booked through. Hence the obsession of the intermediaries to guarantee minimum prices and the rise of websites offering discount coupons, bargains, offers, opaque selling, exclusive discounts… The origin of metasearch websites comes from the need to bring order and simplify a price search that, in practice, the user already does by comparing different websites before booking.

That does not mean that the price was never important; on the contrary, it always has been: however, now, by being able to integrate all the information, it has become an obsession in the industry and, aided by the recession and lack of price parity, we have infected the client with that culture, instilling the idea onto him that booking a hotel is a race to find a bargain. Trivago, Kayak and the rest metasearch websites are tools born from the prominence of prices.

Those three motivations correspond to the three leaders of hotel commercialisation: Google, Tripadvisor and Trivago (and other pure meatsearch websites).

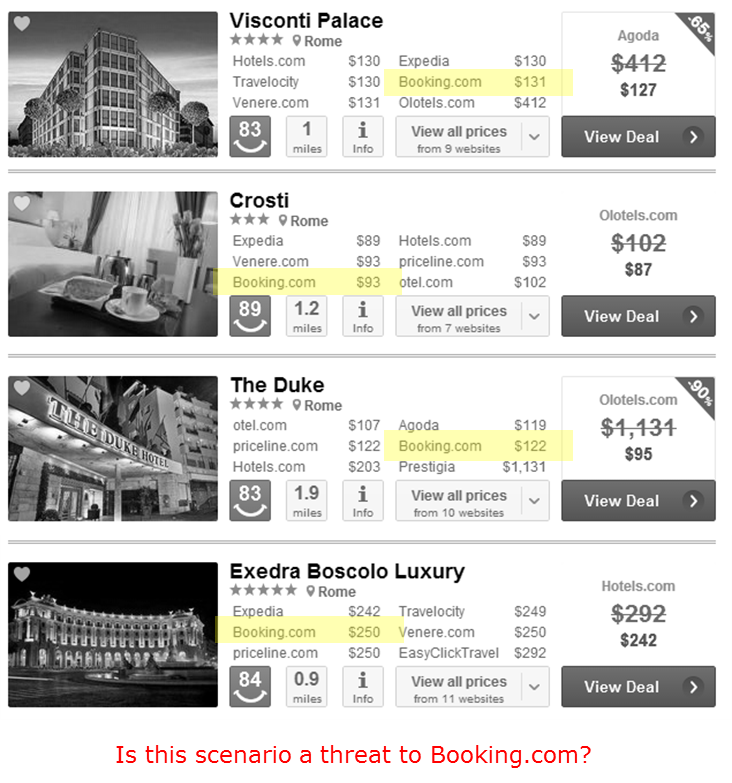

And what about the OTAs, with Booking.com as leader in Europe? Will Booking.com fit in this map of new commercialisation? It has reviews as well as an almost-complete inventory and omnipresence in almost all marketing platforms but… does it have a price? Or rather, does it have the best price? Despite the fact that they proclaim that they do, that is not always the case. It is true that some OTAs usually have the best price but none of them have it always. All you need is a random search in a metasearch website to verify it. So why should the user turn to Booking.com if a metasearch engine offers him many more compared offers, among them the price of Booking.com itself? Will the famous Booking.com ‘showroom effect’ fall short if there are bigger and more useful showrooms out there? If the user discovers it, we could be facing the first threat to Booking.com’s hegemony in many years. Who will take advantage?

First novelty: from partial to total services

Each of the three aforementioned giants, based on their specialisation, have incorporated in 2013 the two sides of that triangle that they were missing and now the user does not need to leave any of them in order to find everything that he is looking for, something that, up until now, required multiple searches.

Google, king of searches, advertising, maps, photos, etc., has ventured into hotel commercialisation by adding reviews and, above all, inventory and price: It has done so astoundingly, by launching all of its service mechanisms and offering hotel prices not only with its new special comparison tool, Google Hotel Finder, but also and more importantly, by placing that information on the results page, on the maps and, in all probability, extending it to its whole universe of products, many of them related to travel. This general Google platform for hotel prices is called HPA.

Tripadvisor, based on its more than 50 million reviews, has added a search by date that offers prices thanks to its recently launched TripConnect, its price comparison with connection to the room providers. Up until now, the hotel ranking in each destination was sorted by user reviews; now, the site encourages searching by dates and it alters the ranking according to availability and prices.

Trivago and the price comparators themselves have also incorporated reviews and a highly efficient search. Its evolution is demonstrated by its advertising. While its advert from two years ago had “always at the best price” as its slogan and end motto, its current advertisement barely mentions it, focusing rather on the full experience.

The term ‘comparison’ falls short to express the complete offer of services that the three companies represent and that, from our point of view, explain their current rise. The three platforms have become more useful for the user, working as excellent showrooms and allowing the user to end up in the different steps of the purchasing process.

Second novelty: they also compare the hotel website

To offer inventory and prices, Google, Tripadvisor and Trivago connect with the main distributors and lead the user to the respective sites of each provider. These interconnections are not new in e-commerce. What the hotelier receives as a booking by ONE distributor with whom he has a contract has probably traversed through various levels of sub-sales and has an origin that the hotel is usually unaware of.

The novelty consists that the three platforms do not just show the availability and prices of the intermediaries but also connect with the hotel websites. Despite that requires a tremendous technical effort due to the amount of connections that need to be carried out, they are advancing quickly. The integration is made not with the hotel directly but rather through the booking system provider.

That direct participation of the hotel website in the comparison websites is voluntary, has a cost and is now feasible for many hotels. If it seems like an important novelty, it is not because the hotel will receive a windfall of bookings the following month (at the moment, the amount is not very high) just by participating, but rather because it opens its doors to big changes in the hotel distribution. Whether the hotelier can adapt or not is what will decide if the rise of the comparison websites can be an opportunity or a threat for them.

Threats

Yes, the growth of comparison websites can be a threat for hotels. Just like with previous changes, it depends on whether the hotelier can adapt or not. The risks come especially from not doing anything:

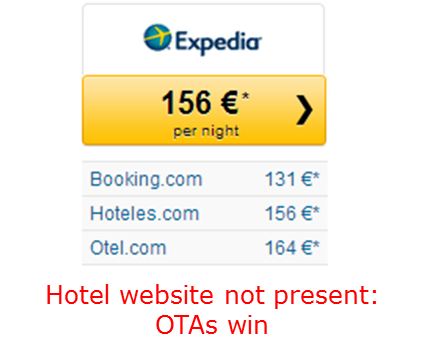

1. Your website will sell increasingly less: … if you do not connect it to the metasearch websites. It is the consequence of what has been explained up until now: If the three large platforms gain prominence for the final client and become decisive when diverting traffic to certain providers, it will be these providers who will benefit from it. If your website is not part of them, you lose the battle.

It is not that you will lose clients. You will have the same ones sleeping in your hotel. By not connecting your website, you are not going to lose them, in the same way that you will not gain any by connecting it. What will happen is that your website will lose market share of your sales.

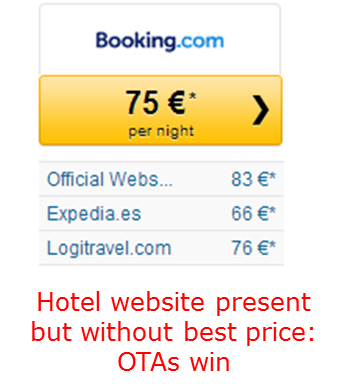

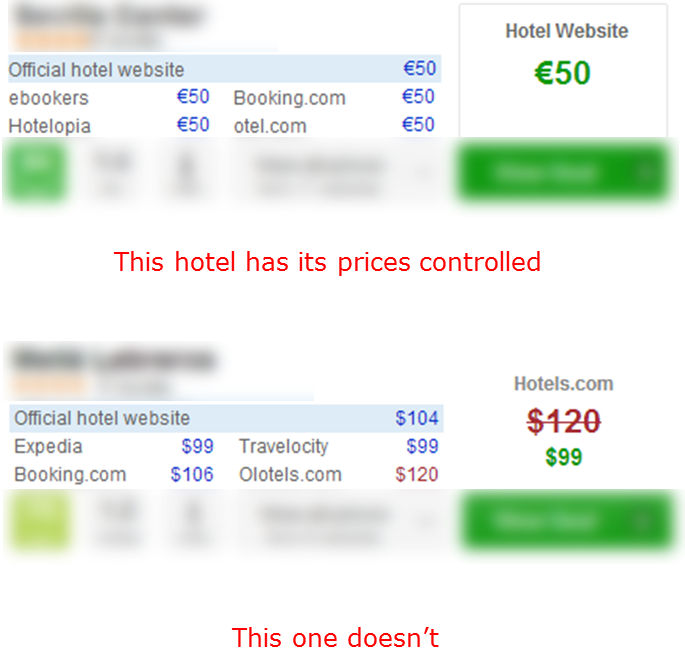

2. Whoever sells to you at the best price will increase your market share. Whether you connect your website or not, the provider who you allow to sell with the lowest tariff will be the one who takes the biscuit. It is your sole responsibility to tolerate it. Comparison websites impartially reflect the reality of your prices and, if they are different among your channels, they will be exposed. This is a clear example of how a simple glance at your prices on a comparison website offers a more clarifying commercialising view than the simple production comparison among your hired channels.

Comparison websites perhaps would not exist if the hotels had price parity. Is their success proof of failure to control hotel prices?

3. Cost increase. The three platforms have created a business model from the connection with the room providers. They charge for the traffic that they direct to those sites. It is an investment that the hotelier pays in all cases, being unaware of it most of the time:

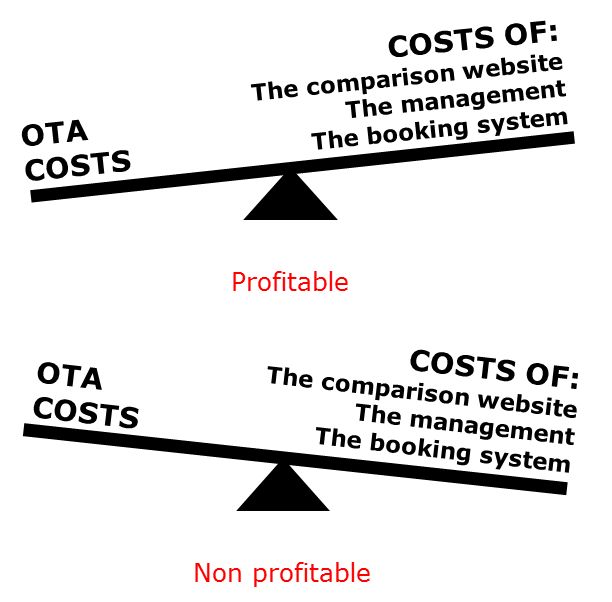

- You are already paying the comparison website for bookings that they generate themselves. You do it through the commissions to the OTAs or distributors (or, if it is a merchant model, with part of the applied mark-up). If the comparison websites gain presence and size, your expenses will also increase. You can only stop this if your website is present and with lower costs.

- Even if you connect your website, its presence must be cost effective for you. It is an investment that you will pay directly to the comparison website, a cost that, for it to be worthwhile, must have as its objective to be smaller than the cost of the booking coming in from other channels. The threat comes from the fact that this profitability will not be within reach of most hotels, as the cost of this presence in comparison websites can become unaffordable, as is happening with Adwords. It is a challenge for the comparison websites themselves: After having carried out costly technical integrations and after having opened the doors to direct hotel presence, it would be a contradiction if they did not offer them acceptable costs and did not facilitate their presence with an affordable economic model. And careful: the profitability threshold is not “covering costs”; it is that those costs are lower than the commissions paid to intermediaries.

First, some minimal requirements

Okay, comparison websites will carry on growing and it seems that the opportunity will come if my direct sale has to be present among them and, also, at affordable costs. The next step? Our recommendation is that you check this out first:

1. Your booking system has to offer you a connection with the comparison websites. Without that technical integration, you might as well stop reading now. Check out the integrations that your booking engine provider can offer you. We recommend that, at least, it is with the three big aforementioned platforms. Tripadvisor publishes its connected partners here. Also, your booking system should be integrated with Google Analytics in order to measure its results.

2. You need experts. Once your website is connected, someone, internal or subcontracted, must be in charge of the management and optimisation of your constant presence and investment. On Tripadvisor, that management is carried out directly by the hotel through a simple extranet. On Trivago and Google, that task is the opposite: the hotelier cannot intervene directly, at least in Spain and at this point in time. It is commonplace for the technological connection provider to also handle this daily procedure. When you connect your website, anticipate that responsibility and, if that task has a cost, take it into account when measuring the profitability of the investment. Campaign management tends to complexity with time and is usually the responsibility of online marketing specialists.

3. Control prices. Why connect your website and pay for it if you offer a worse price on it than on other channels? Few comparison websites will expose it. To graduate from the ‘Comparison’ school, first you need to graduate from the ‘Controlled prices’ one, or you will fail in both.

A sustainable relationship with the comparison websites

Once the aforementioned is completed, you need to establish a way to coexist with the comparison website and a work routine that integrates with your day to day. Perhaps these two recommendations will help you:

1. CPC Mentality. The way in which the three platforms will charge you is not one you will be used to. The traditional models, whether they are agencies or merchants, are based on a percentage on sales made, commissions or mark-ups from net prices, risk-free. Comparison websites, however, charge for every click that their users make on your website’s prices. The technical details are not important. What is important is that you must get used to these costs varying and that you will have to make an investment in advance. This cultural shock, accepting these conditions, is essential to make the most of your presence in engine searchers and, generally, online marketing.

2. Monitor results and do not get mixed up with the details: Our experience tells us that many responsible hoteliers, with good faith, believe that their success in online marketing depends on the level of technical knowledge that they acquire. Since it is such a complex world in constant evolution, the result is usually frustration for the hotelier. Our advice is to leave the details to the experts and focus on monitoring the results.

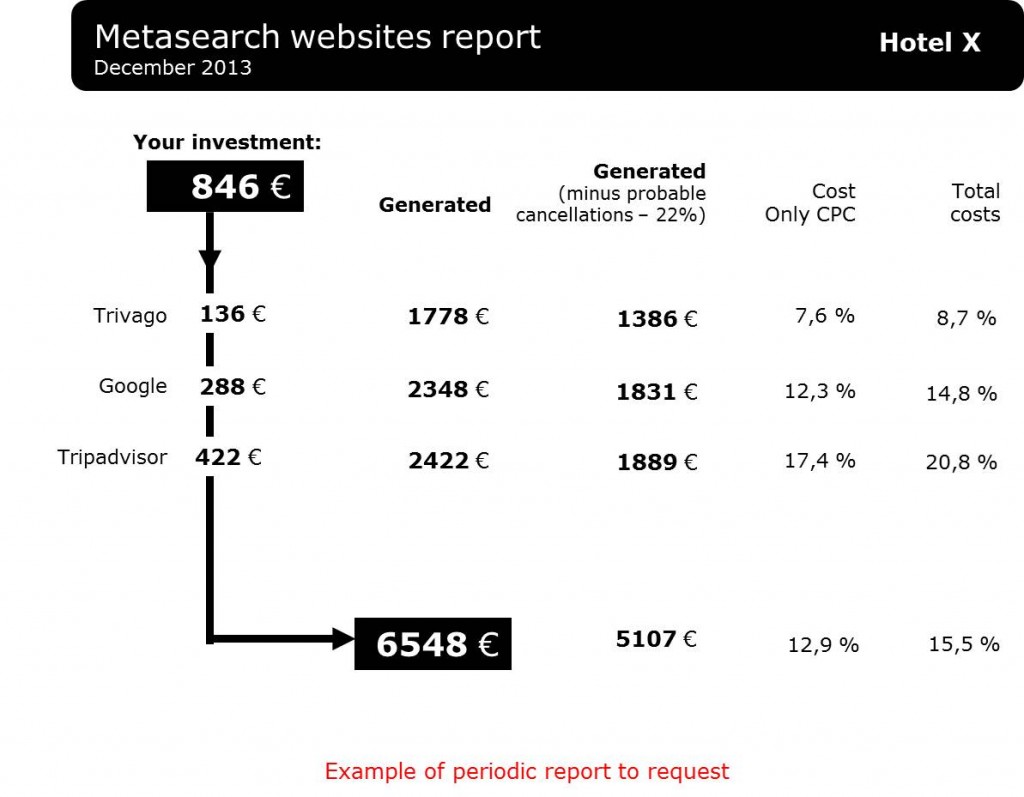

- Your objective is to make a profit: To know the result of your presence in the comparison websites, you need a magic number from which to start from, just the one: the percentage cost of generated bookings. It is a simple mathematical operation: Ask your expert manager to provide it to you:

- If that number is smaller than what the other channels cost you, the result is positive. It depends on the hotel but the threshold is usually between 15 and 20% in Europe today.

- “Costs” is not only what you pay the comparison website. It also includes the costs of the booking systems and the costs, if there are any, of the expert manager.

- The generated production is also a major figure. How much production are we talking about here? Also take into consideration that the main figure should also foresee a certain percentage of cancellations that will still not have occurred.

- On the other hand, you should also take into account that, aside from what has been generated directly, there is another quantity produced indirectly: the bookings by users who consulted you on a comparison website but who ended up making the booking through another channel. The comparison website will not take the credit, it will not be accounted as a generated production but, in practice, it almost certainly contributed to the client ending up making a booking in your hotel. This figure is measurable, it is called multichannel, it is available in Analytics and your expert should provide it.

- The numbers don’t add up? Demand answers. Even to the comparison website themselves. They will be the first ones interested in you obtaining better results.

- Ignore other figures: A manager should not waste time on technical issues. There are countless other variables and an endless jargon that your experts in web analysis and online marketing handle. A director, in our opinion, does not need them and they confuse and demoralise more than they help.

- This would be an example of a periodic report that gathers and ignores the mentioned data:

The peace of mind of having the matter under control

Following the previous steps you will find that your comparison website, in your case, will be acting as your ally, not your enemy. Your website will be competing against them with controlled costs.

Whether the metasearch engines consolidate themselves in their success or not, this will not be a reason for you to worry. Recent history of commercialisation has surprised hoteliers with changes that they have not always known how to react towards. More challenges will come. The comparison website one, at least, will be on the right path and it will have been an opportunity well seized.

Una vez más, muchísimas felicidades por vuestras aportaciones y vuestra privilegiada visión del negocio.

Miguel Ángel, muchas gracias a ti. Un abrazo.