We have great news for our customers in Mexico. The booking engine on your website now has the option to receive payment for bookings through OXXO stores and also allows customers to make the payment through interest-free instalments. This means you can now compete with the top OTAs in Mexico, which already provide these options to customers and thus have a competitive advantage over hotels in their direct sales channels.

If you’re interested in offering payment in OXXO or “Meses Sin Iintereses” as payment methods for your customers, contact your account manager to help you go through the process.

What is OXXO and how does it work?

OXXO is a Mexican chain with thousands of stores in Latin America and manages almost 20% of online transactions in Mexico. OXXO allows customers to purchase online but then make payment in their stores.

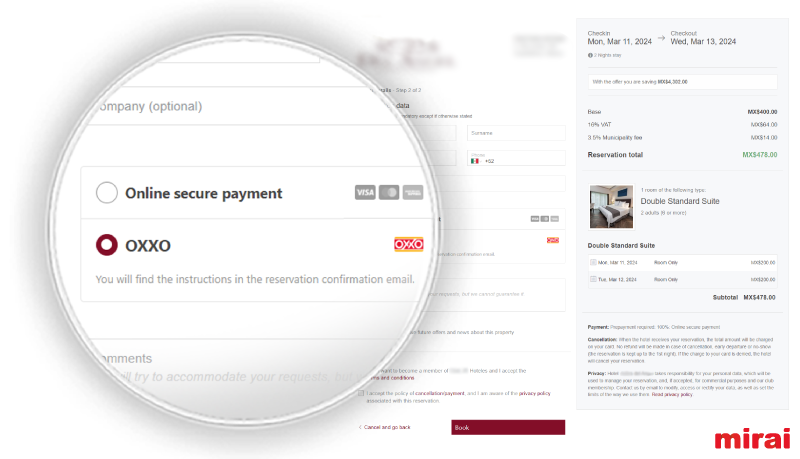

Customers get a voucher with a reference number so that they can complete the transaction. They have to take the voucher to an OXXO store and make the payment in cash. You get the payment confirmation and money the following working day. If the customer doesn’t show up to make the payment, we will automatically cancel the booking and return the room to your room inventory.

OXXO payments have a low risk of fraud or unaccepted payments due to the fact that they have to made in cash in person at an OXXO store. Customers cannot dispute OXXO payments and they also cannot be refunded. That’s why they are only available for rates whose cancellation period has already expired, meaning they are no longer refundable.

Below are the answers to some of the questions you may have

- You can define the payment period you want from 1 to 7 days. If the lead time for the booking is less than that, we will always take this into account to ensure payment is not allowed later than the check-in date.

- Only available for bookings made from Mexico.

- Only available for hotels, apartments or resorts with a Stripe account in Mexico.

- The payment currency is always the Mexican peso (MXN), even if the hotel rates are stated in another currency (such as USD). We will apply the exchange rate in real time when reporting the payment in OXXO.

- Only available for purchases of at least 10.00 MXN, with a maximum of 10,000 MXN. If the booking is for a larger amount, payment will not be offered in OXXO.

- You will receive confirmation of the payment the next working day after the customer has made their payment. Mirai will send a second confirmation to the customer and to you reporting that the booking has been paid.

- Mirai does not apply any additional cost for using OXXO. You can check directly with Stripe the cost that this platform may apply.

- Bookings paid through OXXO do not allow refunds.

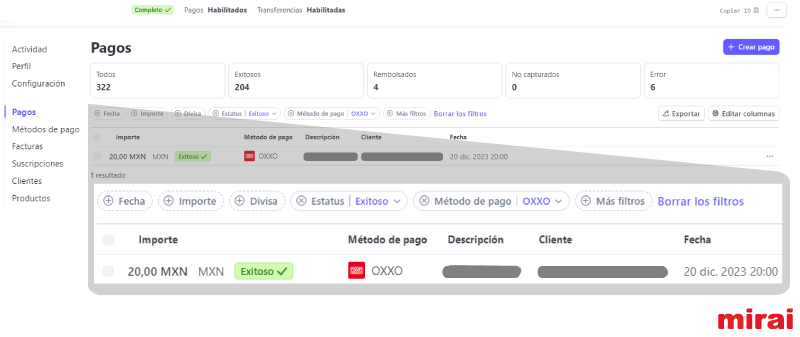

- You can see all the bookings with payment through OXXO and their status (pending, paid, cancelled due to non-payment) in your Stripe dashboard.

You can see all the up-to-date information about payments through OXXO on the Stripe website.

How does the “Meses Sin Intereses” option work?

“Meses Sin Intereses” is something offered by some Mexican credit card companies to allow customers to spread the payment for their purchases across several months. Customers can pay for their purchases in up to 24 monthly instalments. You will receive the full amount (minus a fee) as if it were a normal payment. The customer’s bank will manage the monthly collection of the money over the period agreed.

When a payment is accepted by “Meses Sin Intereses”, an extra cost is added to the standard credit card transaction fee. This amount varies depending on the number of instalments or months selected for the transaction. It can range from 5% to 22.5% depending on the number of months involved.

There are restrictions on the type of transactions and credit cards that can be used for “Meses Sin Intereses”. Stripe automatically determines eligibility for “Meses Sin Intereses” during the booking process.

Again, here are the answers to some questions you may have

- Only available for Stripe Mexico accounts.

- The payment method must be a credit card issued in Mexico.

- The card must be a consumer credit card. Corporate credit cards do not allow fees to be charged.

- The card must be issued by one of the authorized suppliers (Afirmar, American Express, BanBajío, Bancopel, Banjercito, BBVA, Banca Mifel, Banco Azteca, Banco Famsa, Banco Invex, Banco Multiva, Banorte, Banregio, Citibanamex – only for 3, 6, 9 or 12 months-, Falabella, Hola Banco, HSBC, Inbursa, Konfio, Liverpool, Nanopago, Nubank, RappiCard, Santander, Scotiabank).

- The transaction currency must be Mexican pesos (MXN).

- Stripe defines a minimum transaction amount based on the number of months selected. You can specify which type of instalment plans you want to offer and customize the minimum and maximum transaction amounts using the settings in the Stripe dashboard. The total payment amount must be greater than the minimum transaction amount.

You can see all the up-to-date information about “Meses Sin Intereses” on the Stripe website.