En español, en français, em português.

I was recently speaking with the Commercial Director of a small chain of holiday hotels in Benidorm. When we came to discuss basic online marketing issues, he confessed that they were not doing anything because the owner didn’t want to invest. I couldn’t believe it. I asked him: “Don’t you protect your brand on Google? Aren’t you on metasearch engines?”. No. The owner sees it as risky because he has to pay money out in advance with no clear or guaranteed return. Nevertheless, they happily pay 20% commission for reservations from intermediaries such as Booking.com, Expedia, Hotelbeds, etc. Obviously their direct sales are quite low (5% of total sales) and they will stay that way as long as they remain unaware of the opportunities they are missing.

What do the leading OTAs (Booking.com and Expedia) do?

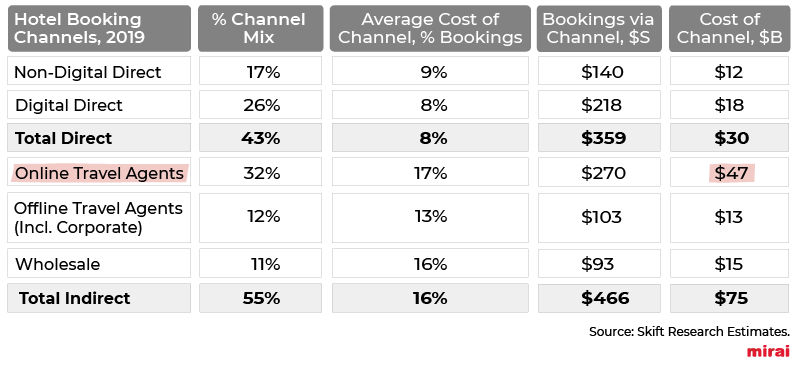

To understand it better, let’s analyze the subject step by step. Let’s start by taking a look at the companies that know the most about hotel marketing, the OTAs. The hotel industry pays OTAs around $47,000M per year in commissions, an average of almost $2,685 per room per year*.

*based on hotel statistics https://hoteltechreport.com/news/hospitality-statistics

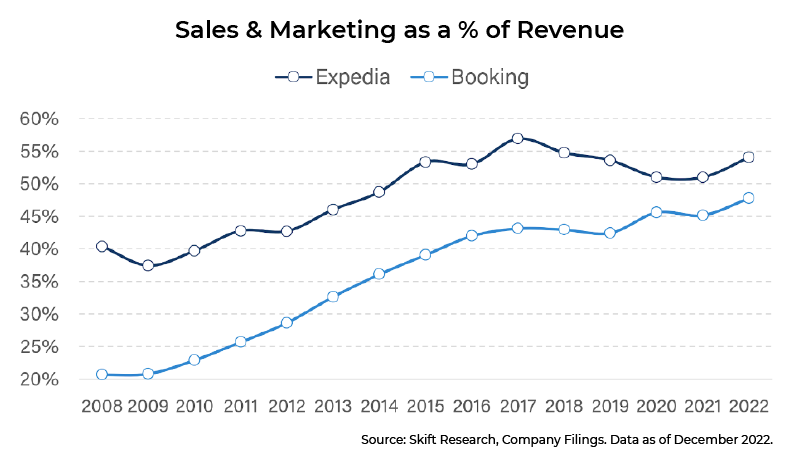

If we analyze the public accounts of the leading OTAs, we see how they are investing heavily in sales and marketing, investing around 50% of their revenues, and with this percentage clearly increasing:

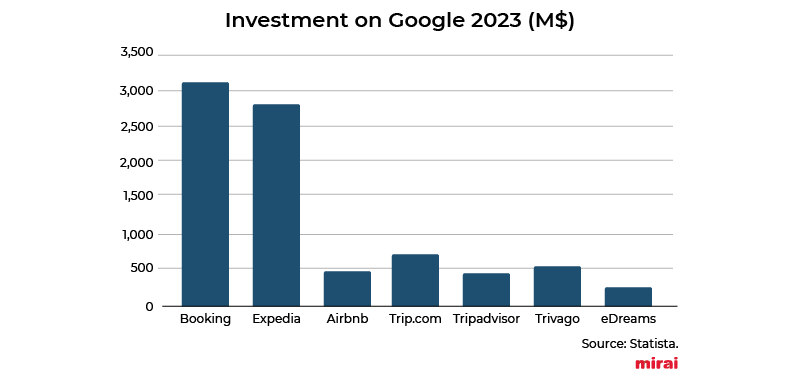

This major commitment to investment in marketing makes Booking.com the biggest partner for Google Travel, with an estimated investment of close to $3.1 billion in 2023, much of this financed by the commissions received from hotels. In total, according to a recent analysis by Hosteltur, OTAs paid almost $9,000M to Google in 2023 ($22,500 per hotel per year).

Source: Statista

However, the million-dollar question is why do they invest so much? Is it profitable?

Well, the fact that they increased their investment by 46.5% over the last 3 years, and that this growth is linked to record levels of growth in their revenues and profitability, seems to leave little room for doubt. As an example, up to Q3-2023, Booking.com had already earned 29% more than in the entire previous year, and had also more than doubled its profit (117%). Source: Macrotrends

In short, yes, it’s very, very profitable. It’s a good strategy.

How does it compare to what hotels invest?

Looking at the aggregate data for nearly 2,000 hotels for which we manage marketing investment, we see an average close to $6,000 per hotel per year, a long way behind what OTAs invest to sell those same hotels. On a percentage level, which allows a better comparison, OTAs invest around 10% of their sales in marketing, while hotels average around 5%.

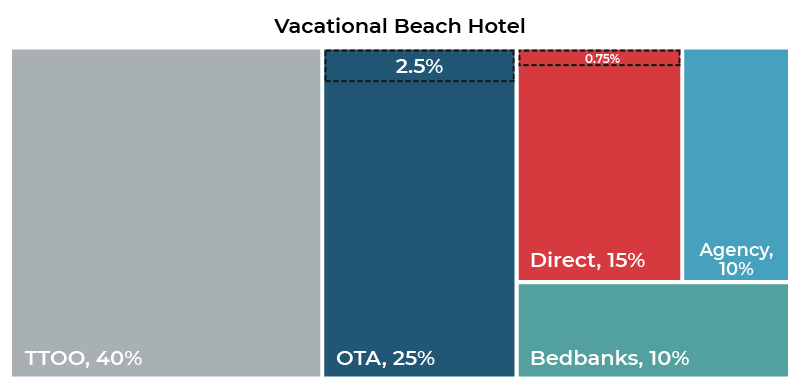

Let’s look at a more “tangible” example based on real data. This would be the average channel mix for a resort hotel where tour operators continue to be the major channel, OTAs represent 25% of sales and direct sales stand at about 15%.

Let’s calculate what OTAs invest in online marketing for this hotel. Taking into account that the hotel pays approximately a 20% commission on this 25% OTA share and that, as we’ve seen before, OTAs allocate half of that commission to marketing, this would result in 2.5% of the hotel’s revenue (20% commission x 25% OTAs share x 50% = 2.5%).

Doing the same exercise for the hotel’s direct sales, taking into account that the average hotel invests 5% in marketing, it would result in 0.75% of their revenues (5% x 15% share = 0.75%).

The comparison in relative terms is clear. OTAs invest 3 times more than hotels themselves using half of the commission they receive from the hotel. Or in other words, with the hotel’s money.

What do more expert hoteliers do?

At Mirai we know quite a few more expert hoteliers, who are well aware of their intermediation costs, the profitability of the different channels and all the possibilities they have to control and maximize their net income (higher profitability). These hoteliers usually began with an initial period in which they were dependent on OTAs, especially Booking.com, but then came to a key moment in which they decided to become more courageous and to take back control of their revenue by doing what was necessary. Slowly but surely. To achieve this, they began investing between 5% and 10% of their direct sales revenue in online marketing (mainly in branded SEM and Metasearch) and around another 5% in technology (website, booking engine, etc.) and dedicated staff. In total they invest between 10 and 15% of their direct sales revenues, with this amount always being less than or equal to the commission they pay to distributors.

It’s also normal for these hoteliers to have started their investments using commission-based models (without any risk, such as commissions per stay -CPS-. Update February 2025: Google will phase out its commission-based models starting February 20, 2025). But over time, and with increasing know-how, they have moved on to more efficient models, especially in channels such as metasearch engines, where they realized that they could win the battle against OTAs, even against giants like Booking.com or Expedia. That’s what many of our clients are now doing, managing to increase their investments and sales while still maintaining efficiency close to 5% of their sales (CPC in Google Hotel Ads optimized with our partner Koddi).

For these more expert hotels, OTAs still account for about a third of their income, but their direct channel is the top booking channel, with a share close to the sum of all the OTAs. Furthermore, with a good CRM strategy they’re also getting customers to repeat their bookings through their direct channel, obviously involving a much lower marketing cost than the initial booking.

So, investment or commission? Both, in the right proportion!

The market has evolved a lot in recent years, especially since the pandemic. The Internet has matured and so have customers. The British and Scandinavians have been booking a lot online for a long time but others, such as the Germans or Spanish, have made major changes in this respect. Currently 80% of customers get their information online and 70% end up buying or booking something.

Online marketing has also evolved, providing opportunities with a greater control over risk and with platforms and functionalities that allow any advertiser to optimize their efficiency. This is something of which OTAs are well aware and also exploit, given that they invest such a large amount of their income in online marketing. They must be quite happy with the performance of their investments since they continue to grow while their profits also skyrocket.

Based on our experience managing online marketing for thousands of hotels, we believe that a good flow of qualified traffic can be achieved through the hotel’s direct channels (web/contact centre) at very reasonable average costs, below 10% of direct sales. Depending on the type of hotel, destination and markets, this approach has allowed the more advanced hotels that work with us to achieve a direct sales share of between 25 and 35%.

So, if investing 10% of your direct sales revenue you can recover a good part of the clients that are currently booking your hotel through OTAs, and with all the benefits that entails, why pay more (commission to the OTAs) and let the OTA own the relationship with the client?

There is obviously room for everyone, so after achieving the 25 to 35% share for direct sales, it’s still important to have a set of strong distributors who work constructively with you and to whom you are happy to pay the agreed commission (probably less than the current 20%).

About Mirai Consulting

Our consultancy and support service for hotels looking to take their distribution and direct sales to the next level. More information at consulting@mirai.com