En español, en français, em português.

Now that we know more about demand in the hotel sector, and what or who can generate it, it’s time to see how Unconstrained Demand for your hotel works and how you should analyse it.

To do so, we will explore the concept of “survivor bias”, illustrated by a classic example from World War II: the Allied Army bombers.

“Survivor bias”: looking beyond success

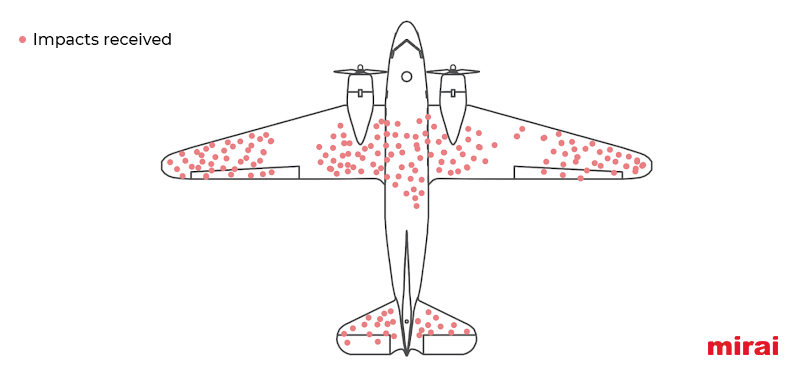

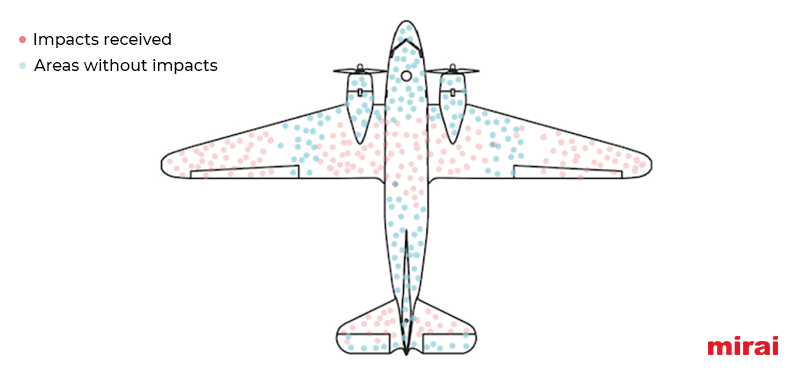

During World War II, the high number of aircraft downed in combat was a critical problem. The solution was to reinforce the most vulnerable areas of aircraft in order to increase chances of survival. To do this, analysts reviewed the impacts received by bombers returning to base.

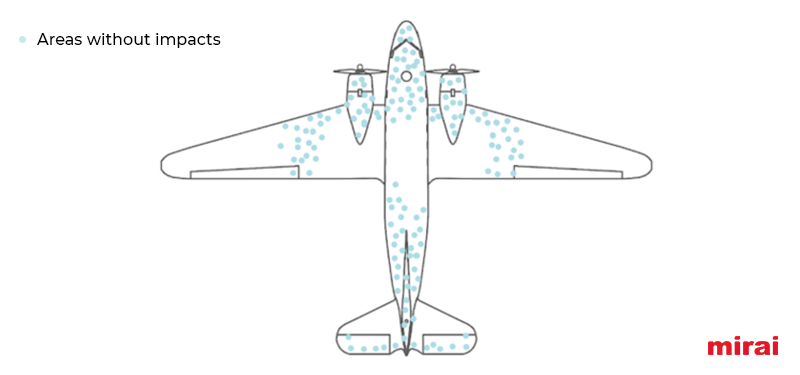

At first glance, it might seem that the most logical thing to do would be to reinforce the areas receiving the most impacts. However, Abraham Wald, one of the analysts, realised a key error: these impacts represented the least critical areas, as aircraft with damage to these parts managed to return. To increase survivability, then, it was necessary to reinforce the areas that did not receive impacts, as these were the areas where damage had caused the aircraft to fall:

This reasoning is a classic example of “survivorship bias”, which occurs when the only stories considered are those that are successful, and failures are ignored.

Application to Unconstrained Demand analysis in hotels

What do Second World War Allied bombers have to do with demand for your hotel? Well, more than you might think.

In the hotel context, “survivorship bias” leads us to consider only sales achieved («successes»), without taking into account lost opportunities («critical impacts»). To get a complete picture of the unconstrained demand for your hotel, it is important to analyse both successes and missed opportunities.

Bearing this in mind, the following would be the main KPIs to take into account when calculating the real (unconstrained) demand of your hotel (time to brush up on your BI, you’re going to need it).

- Bookings generated: this KPI reflects all your hotel’s consolidated sales and provides a clear picture of what customers buy and when they buy it. It is equivalent to analysing data based on success stories, marked in red.

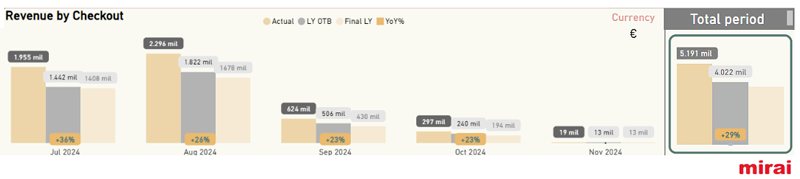

A good OTB (On The Books) report gives us a quick snapshot of all the sales that have been consolidated and the periods in which this successful demand is concentrated.

- Cancellations: while they do not count in the final production, cancellations are part of your unconstrained demand and should be analysed in detail. This includes the reasons for cancellation, as these help us understand the reasons bookings are lost, avoid duplicating data in rebookings, and detect patterns that can be anticipated.

- Non-purchase demand: this is the key piece that is often overlooked. It is equivalent to the ‘invisible hits’ on the fuselage of the aircraft (marked in blue) that you will need to reinforce in order to increase your sales at the lowest possible cost.

This KPI is composed of the sum of two variables that should be taken into account:

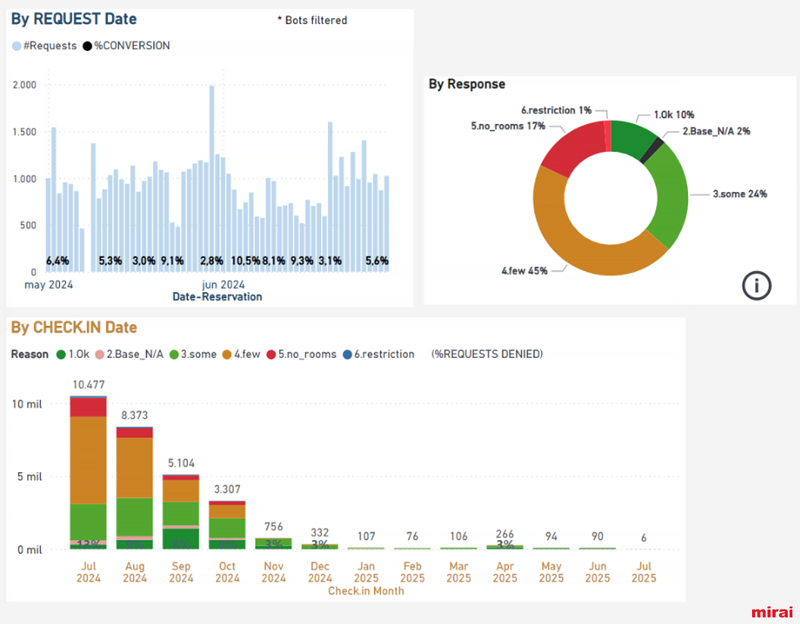

- Demand met without conversion: for example, a customer who visits your website, finds availability for the dates they are looking for, but decides not to book, either because the price seems high or the information about the conditions of the stay is not clear. This indicator allows you to identify problems in the customer experience, such as high prices, lack of confidence or insufficient information about the offer, as well as friction points that can be resolved in cases where customers did not book despite availability.

- Unmet demand: these are requests that are not met due to restrictions, occupancy limitations, or lack of availability. This type of demand indicates areas where you can improve your responsiveness. For example, you could relax stay restrictions or adjust inventory management on key dates in order to avoid missing sales opportunities.

Demand without purchase is an essential indicator, as it reflects both inefficiencies and opportunities for improvement. For example, a high proportion of unmet demand may signal the need to review your pricing or availability policies. Likewise, a low conversion rate to satisfied demand may indicate that customers are finding more attractive offers from competitors, or that your communication is not effective enough.

Moreover, by quantifying this demand you can calculate the associated opportunity cost. This involves estimating the potential revenue that was not generated due to unrealised bookings, taking into account factors such as average price and lost capacity during the periods analysed. This exercise allows you to estimate the potential revenue you could have generated if you had converted or captured that demand, thereby providing a basis for prioritising improvement actions and strategies and achieving a higher return in the more immediate term.

Analysis of these KPIs will give you a complete picture of the unconstrained demand for your hotel, and thus afford you the possibility of capitalising more through actions that depend exclusively on you.

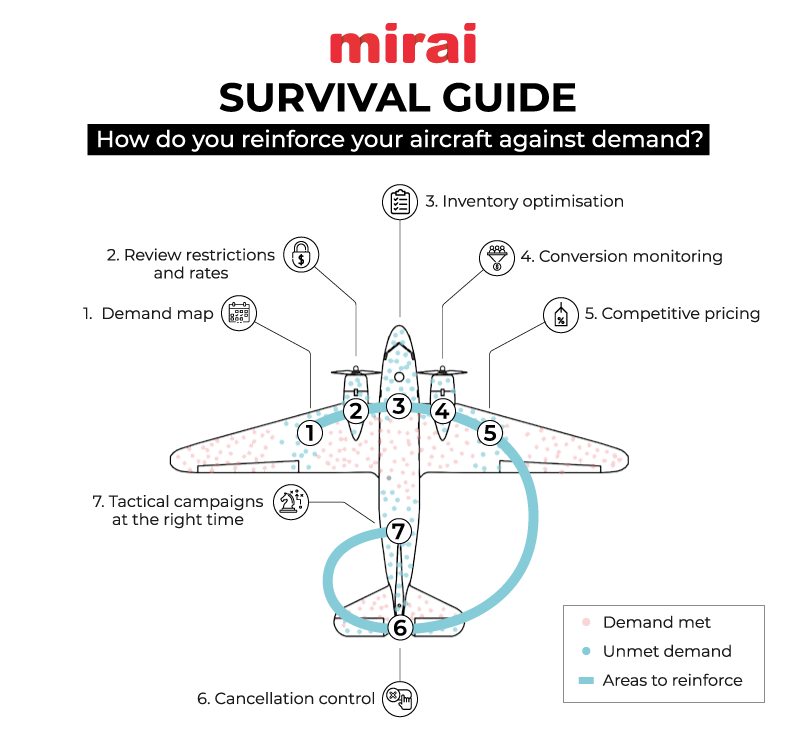

And once you have all the facts, how do you reinforce your plane against demand? Undoubtedly, you will need to address the following points:

- Demand map: create a detailed calendar that identifies cyclical patterns, peaks, troughs and hot selling times. This ‘map’ will allow you to anticipate, plan and align your pricing, restrictions and marketing actions with actual demand, not apparent demand.

- Review restrictions and rates: adjust minimum stays and restrictions at off-peak times in an effort to capture demand that is currently slipping away. You can also apply rate increases for short stays on key dates, thereby maximising margin and avoiding saturating your inventory too early.

- Inventory optimisation: if you know there will be more profitable short-term demand later on, don’t fill your hotel too early at low rates. Anticipate these scenarios and book inventory for segments with higher spending power or confirmed high demand dates.

- Conversion monitoring: detect significant variations in your conversion rate. A spike may indicate an opportunity you are not capturing; a drop may signal a problem in pricing, availability, or user experience.

- Competitive pricing: make sure your direct channel does not lag behind other channels as, more than ever, today’s customer compares. If your direct price is not competitive, you’ll lose conversion.

- Cancellation control: combine flexible and non-refundable rates in an effort to minimise cancellations. This balances the need to offer flexibility without neglecting your inventory or risking compromised revenue.

- Tactical campaigns at the right time: Launch promotional actions or campaigns when demand is present. Don’t waste promotional bullets either with excessive restrictions or in periods of low demand.

Conclusion

Understanding the unconstrained demand for your hotel is far more than just counting consolidated bookings. It’s about analysing the big picture: successes, failures and missed opportunities. With this global perspective, free from “survivorship bias”, you can adjust your strategy and maximise results without investing more in visibility or traffic.

Hotels do not generate demand on their own. They depend on a tourism ecosystem to drive it. The key question is: are you making the most of your existing demand before trying to generate more? Analysing and optimising demand without purchase can make all the difference. Adjust your distribution rules, fine-tune your pricing and improve your inventory and constraint management. You’ll get more value out of existing demand, thereby increasing sales and profitability with no additional costs.

In the third (and final) part of this series, and as a means of capitalising on all available demand, we will explore where and against whom direct sales are competing.