En español, en français, em português.

There is a general consensus that a good room upselling strategy brings a lot of value to the hotel. We summarise it in four points:

- More revenue through higher average booking value. This increase can be even greater in hotels that do not overbook standard rooms to divert guests to superior rooms, and that, thanks to upselling, free up cheaper rooms, gaining competitiveness at the last minute and, therefore, a greater possibility of selling them.

- Higher GOP (gross operating profit), as this increased revenue goes straight to the bottom line. This additional revenue is free of acquisition costs and has almost the same operating costs. If €100 of revenue generates €35 of GOP (35% margin), €110 of revenue (+10% thanks to upselling) generates almost €45 of GOP (+28% GOP). A much higher impact.

- Increased customer loyalty, making them feel important and special, which will have a positive impact on your online reputation.

- More differentiation of the direct channel compared to intermediation, making it more attractive and increasing conversion.

Four major advantages that, in addition, do not entail any drawbacks in return. Implementing a good upselling strategy does not involve any conflict with your hotel competitors or with your channel competitors (OTAs, wholesalers, tour operators). Therefore, it is an improvement that every hotel should implement.

In this article, however, we do not try to delve into the value of upselling (which we have already detailed in this other post) but to quantify it, to get the figures in euros. To do so, we have analysed the performance of the last four months of upselling featured in our booking engine. By way of information, our automated upselling system sends an email to the guest five days before their arrival, inviting them to purchase their upselling with just one click.

More than 6% conversion rate increasing revenues, on average, by 14%

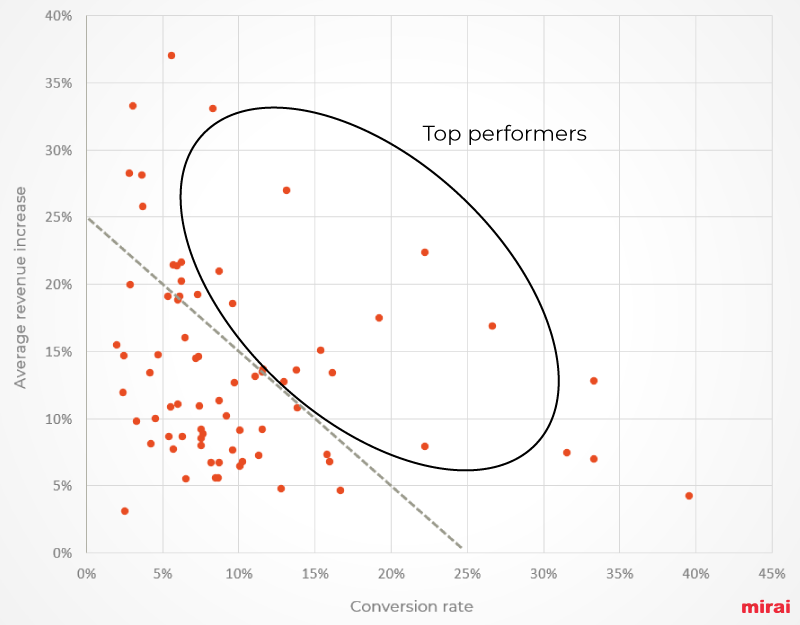

Conversion rate: out of every 100 customers, more than 6 accepted (exactly 6.04%) and purchased the upselling option. We observed a marked seasonality with data ranging from 4% to 7% depending on month of stay, segment and market.

Average revenue increase: among those who purchased upselling, the average revenue increase was 14.05%. In other words, if the initial booking amount was €500, the customer ended up paying €570.

It should be noted that these are average figures, but if we dig deeper we find hotels that are true success stories with conversions above 20% and/or similar revenue increases. We analyse the reasons for this success below.

Another conclusion we draw from this data is that there is a high correlation between conversion rate and revenue increase. The lower the upselling price, the higher the conversion, and vice versa. This confirms that price and conversion (occupancy) are connected.

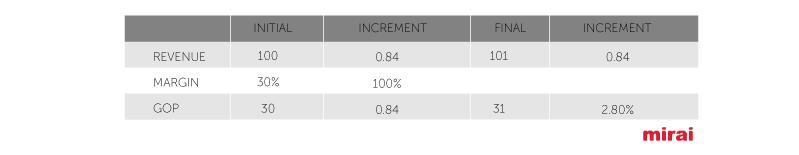

This translates into a 1% increase in total revenues and a 2.66% increase in GOP

- Total revenue increase: By pure mathematics, a 6.04% conversion rate with an average increase of 14.05% generates a 0.84% increase in total revenue. How much does it cost to raise the average price or increase occupancy by 1%?

- Impact on GOP: The most attractive aspect is not the increase in revenue, but the fact that this additional revenue mostly goes straight to the GOP. As there is almost no acquisition cost associated with this new revenue and the operating cost is virtually the same, this 0.84% increase in revenue translates into a 2.66% increase in GOP. A godsend for any financier.

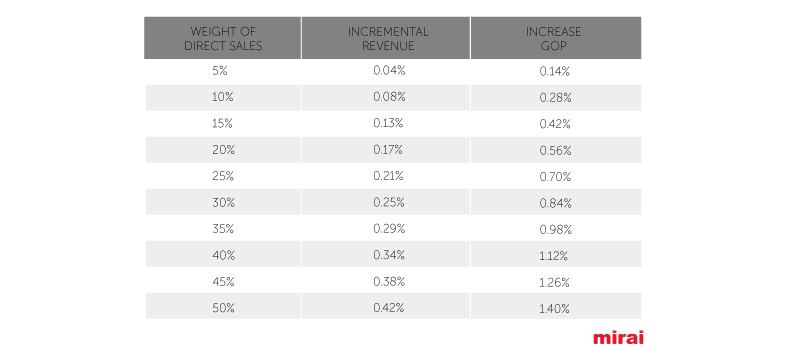

Note that we are talking about the revenue and GOP generated by direct sales, which is never the total revenue (that is where we are measuring upselling performance). How it impacts total revenue depends on what upselling means for your hotel. In this table you could see the impact on your total revenue.

Could this increase in revenue and GOP be extrapolated if we were to offer upselling in all channels?

Yes, on the revenue line, assuming the same performance of the upselling system, which remains to be tested. Not, however, on the GOP, as the costs for each channel would still be high. In any case, increasing the hotel’s total revenue by almost 1% with a technological improvement is really attractive.

What do hotels with the best room upselling performance have in common?

We have analysed the keys to success for the hotels with the best numbers. Here is their recipe:

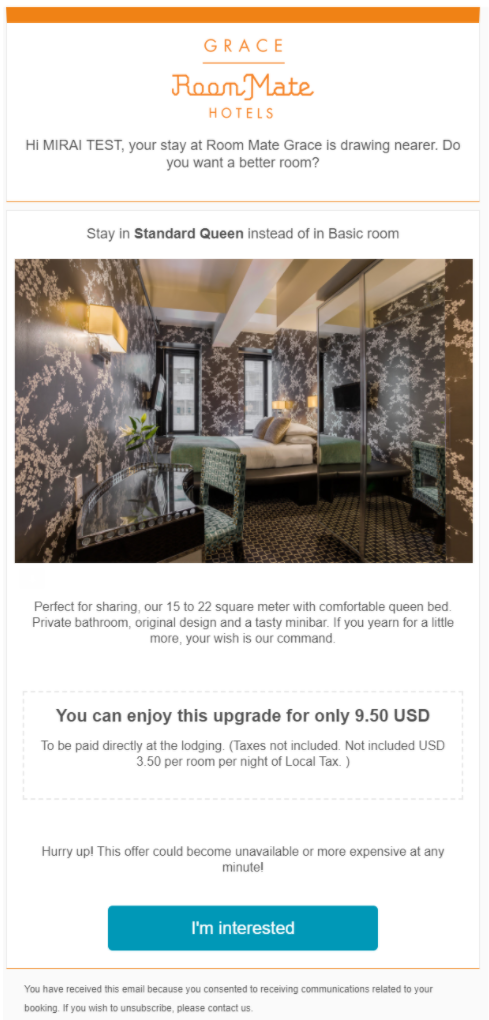

- Attractive photographs and texts. Undoubtedly one of the most impactful variables. Quality content presented in a simple and elegant way, highlighting the difference between rooms and showcasing their unique services.

- High room segmentation. The more room types, the more options the customer will have to choose from and the more accessible (competitive) the improvement will be. Going from standard room to suite is not the same as having three types in between (superior, executive or junior suite).

- Playing with the views. The rooms are often the same, but what changes are the views. Many hotels still don’t clearly differentiate between them or value them. Who doesn’t want a view of the beach or the mountains for a small extra charge?

- Added services. Why not offer an upgrade that includes a service such as parking or access to the spa? Even if we don’t have many room types, we can create them by adding a service valued by customers.

- No restrictions on last-minute sales. There are still hotels that work with release periods or restrictions imposed by the hotel (less so in the commercial department). Hotels with better upselling figures tend to have minimal or no release periods.

- Controlled distribution and better pricing on your website. Direct selling is very susceptible when OTAs “break” your price. Even more so if those OTAs are Booking.com or Expedia. Upselling conversion, like your website conversion, is highly correlated to keeping an eye on the pricing of OTAs.

- Availability until the last minute. Our numbers suggest that upselling on high demand dates drops considerably. The reason is just the lack of inventory of superior rooms. While this is a good problem to have, being sold out within five days of check-in indicates that, to some extent, you have sold below the price the market could pay you. Easier said than done, but the hotels that have the best conversions are those that keep inventory to a maximum on these hot dates.

Enemies and challenges in implementing an upselling strategy

Paradoxically, and despite all the advantages we have seen, very few hotels implement upselling strategies. The main reasons are:

- Hotel operations, the biggest problem being the lack of truly automated solutions where the hotelier does not have to intervene and which include all the hotel’s different technological platforms (booking engine, CRM, channel manager and PMS). It was in this spirit that we designed Mirai’s upselling system.

- Lack of interest in the subject. Many people think that the numbers don’t pay off or that it is a lot of work. With this post we hope to have aroused their interest.

- Overlapping with other initiatives of their own. A common mistake is to think that upselling has to happen once and that if it is already in place (at reception, for example), there is no need to implement it at other times. The trend is to offer upselling to the customer wherever it makes sense and in different formats (digital and face-to-face). There are many types of customers and each will be more suited to one medium or another. Don’t assume that all customers think and act the same. Although there may be some overlap, the sum of all upselling points will always be higher than having it at just one point.

- Conflict with incentive schemes for reception staff. It is common, and good practice, to incentivise reception teams when they achieve upselling. Implementing a digital upselling system within days of arrival should not be in conflict with these incentives. You could keep the incentive to the team for each digital upsell, or double the incentive if they achieve another upsell on arrival. There are many ways to approach it but the solution is not to do nothing. Whatever is good for the hotel is good for the hotel teams.

Conclusion

Hotel marketing is always working on two axes: how to compete with the rest of the hotels in the destination, and how to use my website to compete with the other channels. In this double battle, the objective is threefold: increase average price, increase demand (occupancy) and reduce intermediation costs. Each point of improvement in any of these areas is a victory.

Interestingly, a good room upselling system in your direct channel offers a high-value alternative as it increases average revenue and average price without increasing operating costs, and reduces the cost of intermediation.

What are you waiting for to implement a good room upselling system in your hotel?