En español, en français, em português.

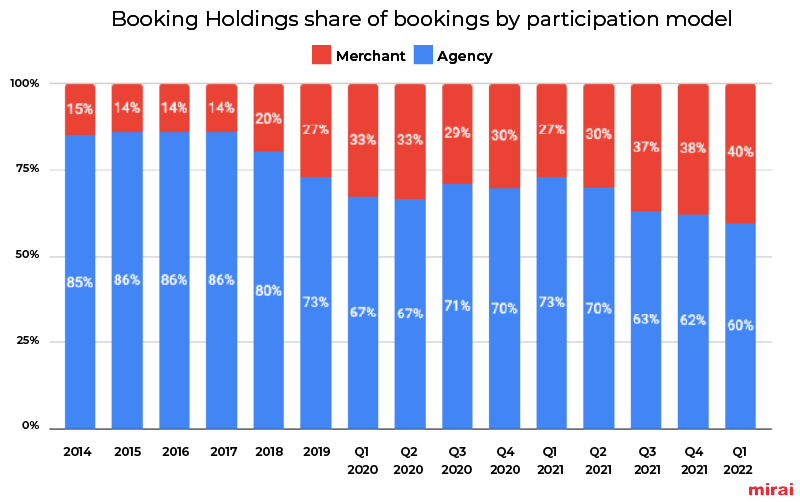

Four out of ten (40%) Booking.com reservations in Q1/2022 were processed through the OTA’s payment platform, an 48% increment compared to the last year (Q1/2021 accounted for 27%) and twice as much as just four years ago (2018) when the number was 20%.

This steady and growing trend shows Booking.com’s determination to migrate from its original “agency” model to the classical “merchant” model used by many OTA’s and bedbanks. After an important effort pushing this new model aggressively onto its suppliers, Booking.com has already reached 60% adoption globally. A very good number with still room to onboard more properties in coming months/years. So we expect this 40% to grow in 2022 and 2023.

What is the rationale behind this shift to the merchant model? Should it worry hoteliers? How should hotels adapt their strategy to compete with this “new” Booking.com? We cover all these topics and much more in this post.

Booking.com and the agency model

Before we go deeper, let’s briefly remember how each model works:

- Agency model: The client pays the final price to the hotel (either at the time of the booking or at the check in). Typically after the check out month, the hotel pays the agreed commission to the OTA.

- Merchant model: The client pays the full final price to the agency or OTA (not to the hotel). Normally after the check in date, the OTA pays the net price (final price – agreed commission) to the hotel.

“Gross rates” (when the hotel sets the final asking price) have traditionally been tied to the agency model whereas “net rates” to the merchant one. However, it’s not a technical requirement and you can distribute both rates in both models. When Booking.com first started years ago, it exclusively operated under the agency model as opposed to its archirival Expedia, that mostly operated under the merchant model. This agency model was indeed part of Booking.com’s huge initial success as hotels loved the many advantages this model offered:

- Positive effects on cash flow.

- Removed the risk of the agency going bankrupt without paying hotels.

- More information about your clients before they go to the hotel.

- For the first time, control over the final price clients paid.

Booking.com’s success story

The OTA has been extremely successful for the last 15 years without having to modify its agency model. This huge success came not only from good decisions by Booking.com’s management, but also by the many concessions the hotel industry has made so far.

Reasons for Booking.com success |

|

| Booking.com’s great decisions | Hotel industry concessions |

| Agency model (innovative back then and with many advantages for hotels) | Considered Booking.com a true ally without noticing the many cons it had. |

| Branding (image, security, confidence, loyalty) | Let the OTA steal the “free cancellation” badge |

| Loyalty (Genius) | Supported Genius program with lavish discounts paid for by the hotels |

| Technology (ux, search capabilities, filters, maps, app, etc) | Allowed the OTA to bid on search engines with the hotels’ names and trademarks |

| Marketing (SEO, SEM, metasearch, email marketing, audiences, etc) | Bought the “parity and inventory clause” that only benefited the OTAs in the long term |

| Content (reviews, copy, translations into 40+ languages, high quality pictures, etc) | Lack of investment in their own direct channels (technology and marketing) |

| Innovation (constant A/B testing, new formats, etc) | Treated clients who booked on Booking.com better in hopes they would write favorable reviews. |

| Partnerships and affiliate network | Accepted every single program or initiative that promised “more visibility” without much push back. |

Why the agency model is Booking.com’s biggest bottleneck today

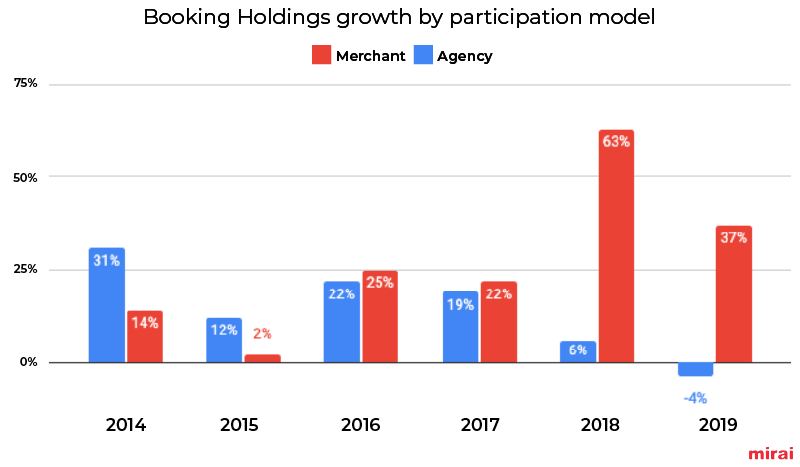

So far, Booking.com has grown to an unimaginable size becoming the largest OTA in the world. Its success is unquestionable. We should remember that Booking Holdings, as a public company, is pressed and even forced to constantly grow no matter what or how. The agency model, combined with an intense M&A activity, had supported this vigorous growth until very recently. However, Booking Holdings’ size makes it harder for them to sustain the same growth trajectory. Last years’ numbers confirmed that growth is mostly driven by the “merchant model”, whereas the “agency one” has stalled or even decreased, showing cannibalization or transition of bookings from one model to another. 2020 and 2021 data is an outlier and difficult to evaluate because of this. The trend continues, though, in Q12022 with the merchant model growing 241% over Q12021 – three times faster than the agency model (87%).

Additionally, most of the initiatives to achieve growth expectations demanded the capability of charging the end client, adding even more pressure to accelerate the shift.

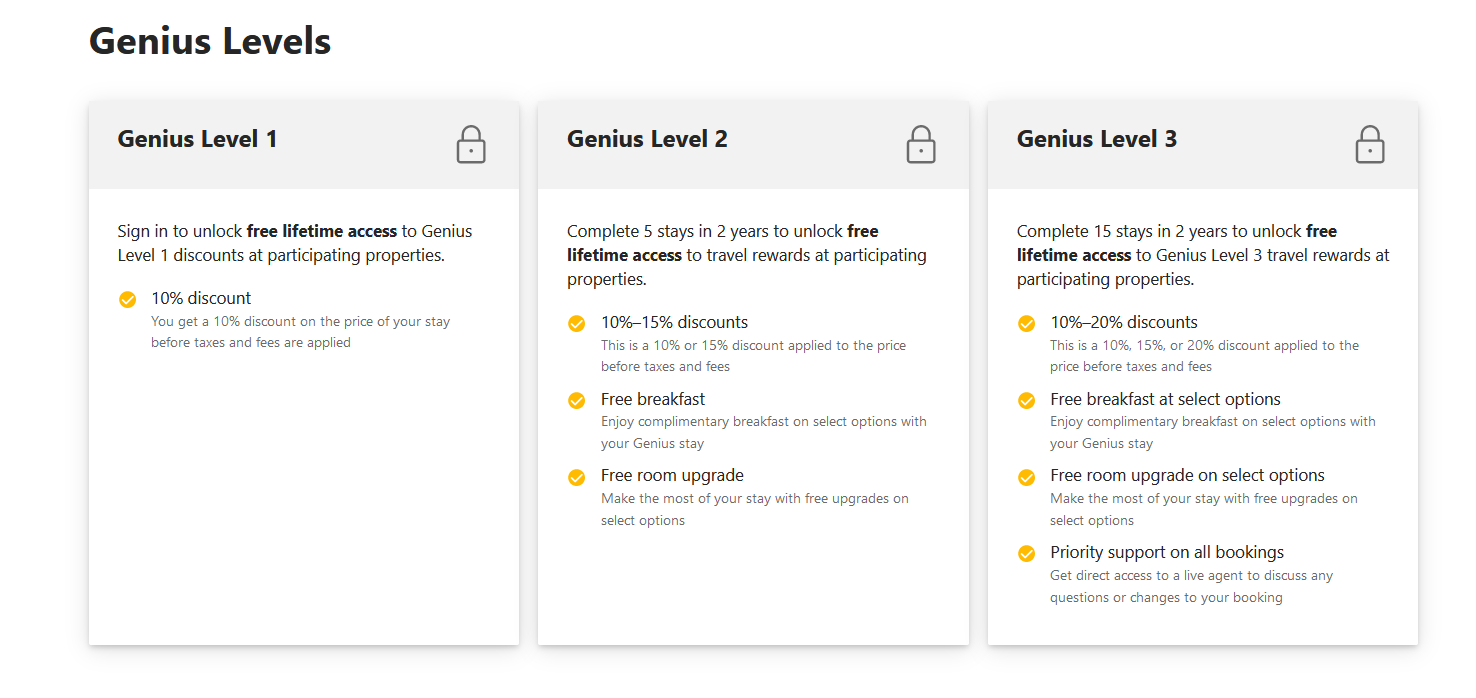

- A true loyalty program. Booking.com Genius required a tremendous investment and effort under the agency model. However, evolving the program under the agency model was becoming unsustainable as Booking.com depended on what hotels accepted or not in order to enhance the program such as adding different levels, giving away travel credits and rewards, offering free upgrades, airport transfers and other perks that many hotels have traditionally kept for their direct channel. The merchant model was needed.

- Hotel + flight bundling, air tickets, restaurants and rental cars. Totally new and incremental markets for Booking.com that had been traditionally dominated by Expedia. Again, the merchant model was essential. To cross sell services, Booking.com launched the idea of “connected trips”.

- Alternative forms of payments. In many countries, credit cards are not the most used form of payment. Amazon Pay, Apple Pay, Klarna, Wechat and Bizum are just a few examples of what worldwide clients use to make payments. Under the agency model, hotels would have to adapt their procedures to accept these new forms of payment, making it an impossible mission that would never scale. The merchant model again is the solution.

- B2B platform. The merchant model is the standard among the thousands of OTA and agencies around the world. Just a few of those evolved and adapted to the agency model. Most of them worked with the leaders in this arena: once again Expedia and other wholesalers such as Hotelbeds.

- Alternative lodgings. Hotels know how to charge end clients. However, private apartments, villas, short term rentals and other alternative options represent very large long-tail properties without any intention to manage payments. Let’s remember that if Booking.com wants to compete with Airbnb.com, it needs the merchant model.

- Positive impact on cash flow. If Booking.com charges the client on the booking date and pays the hotel on the check-in day, it will keep the money for quite a long time. This has a huge and positive impact on its cash flow reducing its need for any debt as well as potentially generating more financial revenues.

- Foreign exchange opportunities. Consumers tend to be more comfortable paying in their own currency for example $490 instead 10,000 Mexican pesos. This presents a great opportunity to OTAs to “play” with the FX (foreign exchange) rate and get an additional % of the charged amount. Why not add some dollars and ask for $499 instead (and a nice 2% extra commission)? Why not even more (until the client realizes)? This is a very common practice in many industries, especially travel. Once again, the merchant model is necessary and all the wins goes to the OTA. None to the hotel.

Given all the above, the optimal model is the merchant one. The agency model had to die. The plan to shift from agency to merchant has started. Fortunately for Booking.com, it had acquired Agoda back in 2007, an OTA that mostly operated under the merchant model. Additionally, Priceline.com (another brand within the group) also mostly employs the merchant model. The solution was at home. Booking Holdings only had to streamline the technology and make it available to Booking.com. Something it did fast and very effectively, making this “new merchant model” available to hotels a few years ago. The official name is “Payments by Booking.com”.

Advantages of the merchant model for hotels

It was probably great for Booking.com to realize that the merchant model not only unlocked so many opportunities, but also had a very attractive sales-pitch to suppliers. There are three undeniable advantages for hotels in the merchant model:

- Dealing with payments is definitely complicated and a lot of work, especially for independent properties.

- Fraud and chargebacks are very painful for hotels. There are few things that frustrate hoteliers more than receiving a chargeback from a client, especially when he/she did enjoy the stay in the hotel. A bad chargeback experience can last in the hotelier’s mind for ages. Booking.com knows it and lures hotels to its payment solution arguing that they would forget about these frustrating experiences (which is true). A brilliant example of pain point marketing.

However, the OTA does not relate, and even less addresses, the root of the problem which is the very low quality of its bookings compared to other channels. By “quality” we mean the chance that these bookings are ultimately canceled or, even worse, end up in a no-show. It is somehow contradictory that Booking.com appears to be “solving” a problem that they are part of. Nonetheless, the OTA very smartly positions itself as the solution and, once again, the hotel industry takes the bait.

- Accessing new demand (according to Booking.com) from users “eager” to pay for their rooms using alternative forms of payment such as Paypal or Apple Pay. Although it sounds great, two facts make this a questionable argument. The first one is that the OTA does not offer any filter to only select properties that accept these new forms of payment. If there are no filters, where is the incrementality for those who accept them? Don’t confuse it with the “Booking.com Wallet” filter as this is to only show hotels that accept where you can use your travel credit. The second reason is that none of the reports show information about how many clients booked using each form of payment.

PCI and PSD2, Booking.com’s unexpected allies

Good news (for Booking.com) kept arriving with more tailwinds.

First, the bank industry and, later on and in the European Union, politics complicated things even more. Frameworks such as PCI and regulations such as PSD2 came into place. In order to become compliant, hotels needed better procedures, technology and knowledge on how to deal with credit card numbers. Otherwise, they bore part of the risk if fraud is claimed by the client. Booking.com came to the rescue with its payment program. Just relax, sit down and enjoy life hotelier. We’ll do the hard work.

The bad news. What the merchant model brings that hotels don’t like at all

At first, it might look like a romantic Hollywood with a happy win-win ending. Unfortunately, this is not the case. The merchant model has big negative consequences for hotels:

- Higher cost. VCC or virtual credit cards that Booking.com uses to pay hotels have an additional commission to hotels that averages 3%. Expedia uses VCC as well but it calls them EVC or Expedia Virtual Cards. Most of the VCCs are issued in the US and the European Union, so for hotels located outside these two areas, their costs will be even higher as there is an additional cross-border fee to process payments.

Unsurprisingly, Booking.com may get a nice chunk of this commission in the form of rebate by the financial institutions and credit card companies, creating a new, lucrative and totally incremental revenue stream for the OTA’s. So large that Booking has created an exclusive fintech division to develop this opportunity. Will we see Booking.com offering its payment platform to hotels in their direct channel? Time will tell.

The tricky thing about the extra VCC costs is that they often go undetected by the revenue managers as they are not cited anywhere within Booking.com’s extranet. Only the CFO of the company would eventually notice them, long after they have occurred.

- Negative impact on cash flow. If Booking.com collects your non-refundable rates and pays you on the booking date (according to its own payment FAQ page, “this is generally set to one day after the check-in date, except for eligible properties where the VCC is activated when the reservation becomes non-refundable”, you’ll lose the positive impact on your cash flow as it goes straight to the OTA.

- Loss of differentiation. Many hotel chains used perks such as transfers and upgrades to differentiate their direct channels. If Booking.com massively does this, this differentiation will be gone.

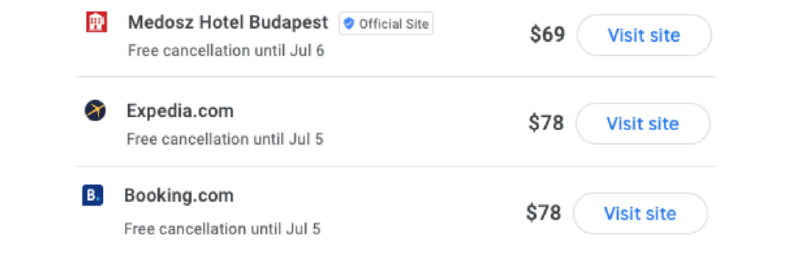

- Potential disparities. Would you give the largest OTA in the world the capability to undercut your direct channel with its margin? That’s exactly what you’ll be doing if you participate in “Payments by Booking.com” solution. No matter what “parity checker” you have, it’ll be impossible to prevent Booking.com from being able to undercut you wherever they decide: in the mobile app, by market, by device, by audience, by repeating or new client, or by any other variable the OTA can think of. You can argue that Booking.com was already undercutting you with Booking Basic. However, it is not the same. You could close or markup these 3rd party channels (Agoda, Ctrip, Hotelbeds, etc) to prevent Booking from pulling rates from them. Will you do the same with Booking.com?

Finally, those with experience in B2B know that third party OTA’s buying inventory from a B2B is one of the main sources of disparities. It is already difficult for you to control Expedia and Hotelbeds (it’s hard even for them to control their partners). Are you sure you want to add Booking.com to the list?

So it’s your time to make a well informed decision: do the pros of the merchant model really outperform the cons? They don’t. However, Booking.com is very smartly presenting the program as if it was the best decision for you. Booking.com is, once again, persuading you to concede one of the few things you still had: the control of your price.

Things hotels should do to compete with Booking.com’s merchant model

The first piece of advice is to stop participating in this program. So far, it’s still optional for hotels to opt in. I’m afraid, though, that it may eventually become mandatory (as is the case with Expedia). But while you have an option, we recommend that you halt your participation as soon as possible.

If you are required to participate, or decide to participate nonetheless, you should update your direct channel strategy to compete head-to-head with Booking.com under this new framework.

- Build your own loyalty program and move all your existing bookings through it. You can potentially add levels to better segment your loyal clients. Add a unique value proposition for each level and show it everywhere on your website. Your customer base will rapidly grow, gaining access to your clients’ personal data to later tap them in future email marketing campaigns such as Black Friday or Christmas. Remember we are heading to a world without cookies with a known D-day (07/2023), so storing client first-party data is a must for all hotels.

- Ensure you show in your direct channel the best rate of all your channels, including of course Booking Genius Level 1, 2 and 3 (or the ones yet to come). Better than Expedia Rewards too. Make your best rate available on your website and on all metasearch engines. The more visibility the better. The battle over price has changed dramatically in the last few years. Legal restrictions to impose parity and loyalty programs on both ends (OTA and hotels) have changed the tactics in this regard. As a consequence, OTA’s will undercut you whenever they can and want (and it’s legal) and you should do the same, ensuring your most valuable clients will find the most competitive rate in your direct channel. You could tie this best rate to your loyalty club so you have a shield in case an OTA dares to reach you. However, it’s contradictory how OTA’s push hotels for rate parity when they are the first ones to undercut you.

- Manage inventory wisely. Remember you have the most powerful weapon in this battle which is the control over the inventory. Forget the “inventory parity” rule that mostly benefited the OTA’s in the past. The high season will always be the high season regardless if you still have zero rooms sold. Why are you giving away rooms to long-tail channels that only sell a few room nights each year? Management of the last rooms on a given day should also be updated. Most profitable channels should be prioritized to the detriment of the most expensive ones (have you calculated how much Booking.com normal commission + preferred + commission over taxes + genius discount + VCC extra cost you? You may be surprised). Configure appropriately your CRS or channel manager to automate the management of the last rooms available so you close or markup the most inefficient channels leaving the most profitable ones open at all times.

- Offer directly better cancellation policies and payment terms. A good example is keeping “non-refundable” rates in Booking.com and converting them to “30-day cancellation notice”. This change makes a huge difference in high booking window reservations. Flexibility is highly valued by clients and will help you drive more direct bookings even when Booking.com lures them with Genius benefits.

- Implement an automatic upselling system improving your clients’ experience, increasing your average ticket value up to 14% and differentiating your direct channel. All in one. Having the option to easily upgrade your room type a few days before the check-in sounds like a great and exclusive value proposition. No asterisks and no “subject to availability”.

- Accept alternative forms of payments (and wallets) on your website. There is no doubt that some clients prefer to pay or book with one of these new forms (Paypal, Amazon Pay, Wechat, Bizum, Google Pay, etc) rather than use a credit card. Let them do so. Contact your booking engine and ask them which alternative payments they support and the conditions. In Mirai, we have integrations with more than a dozen payment gateways so you can choose the one that best suits your needs.

- Ask Booking.com to pay you through “wire transfers” instead of VCC. According to its “payment FAQ” page, “bank transfer” is also an option although “not all properties are eligible for payments by bank transfer”. It does not clearly state either when they pay as it “When you receive bank transfer payments will depend on the schedule you’re set up for”. Remember VCCs have the advantage (compared to wire transfers) of cash flow as you can get the money faster, but bear a higher cost (3% on average) whereas with wire transfers you get the money later (starting in 30 days after the checkout) but are free of cost to you.

If VCCs are your preferred payment option or you simply don’t have a choice, at least ask Booking.com to pay you the non-refundable rates at the time of the booking instead of at the check in date. According to its own FAQ page, this option is “eligible properties where the VCC is activated when the reservation becomes non-refundable”.

In both cases, and given the lucrative business VCCs and paying late are, you can expect some reluctance to attend your demands.

- Get out of your comfort zone. Booking.com lives very well with you in it. Question every new “opportunity” that comes from the OTA. Think twice, or three times, before making decisions that may look small or irrelevant but can have bold consequences. Adapt your mindset in a way that you learn what Booking.com suggests and apply those recommendations exclusively to your direct channel.

- As long as Booking.com or any other channel with low quality bookings, you should implement an IT solution at the CRS or PMS level to address it. Otherwise, you’ll continue to have payment problems and potential chargebacks. An automated solution could be asking your clients to proceed with the payments in a secured environment and guaranteeing a direct payment via emails or SMS. As always, the pareto (80/20) rule applies. Start with the high season and the most expensive bookings.

- For selected destinations, you may consider bundling yourself hotel+flight the same way OTA’s do. Competing with Expedia and Booking.com in this segment is not easy but certainly doable. We signed a deal with Onlinetravel to offer this bundling to our clients.

- Stay educated about payments. They are complicated and have hidden consequences. Some hotel industry associations are providing on-going educational support. Keep up to date with HEDNA’s Open Payment Alliance or HTNG’s payments working groups.

Conclusions

Very few dispute Booking.com’s enormous success, performing relatively well even in the pandemic. However, the direct channel also did great, reaching record level marketshare that has been sustained until now. The shift to the merchant model seems unstoppable, but as of today, the program is still optional. Therefore, the first decision hotels should make is withdrawing from the “Payments by Booking.com” program. Our bet, however, is that Booking will make it mandatory sooner rather than later. Or mandatory in Booking.com’s way which is making it a requirement to participate in the preferred or Genius programs. When the time comes, you should be ready. The sooner you start with a new strategy, the better prepared you will be and the bigger impact it will have.

Nevertheless, a direct battle with OTA’s on a level plainfield may not sound that bad for hotels in the long run. The apparent calm we have today might be even worse. Showing all the cards on the table is an opportunity for those who understand what is going on, are ready to make decisions, take optimizing their distribution seriously and want to make things correct. For the rest, however, higher costs and more dependency on Booking.com is unfortunately around the corner.

Great article. I agree all the way. Thank you !

A very well written analysis of what Booking.com is in the process of executing. As an ex-Booking.com manager I think this article is absolutely spot on.

Thank you, Guillaume, for your message. It means a lot, especially coming from an ex-Booking.com manager!