En español, en français, em português.

This first post took a deep dive into each of the six areas in the metasearch funnel, explaining the most important variables in each step and their meaning.

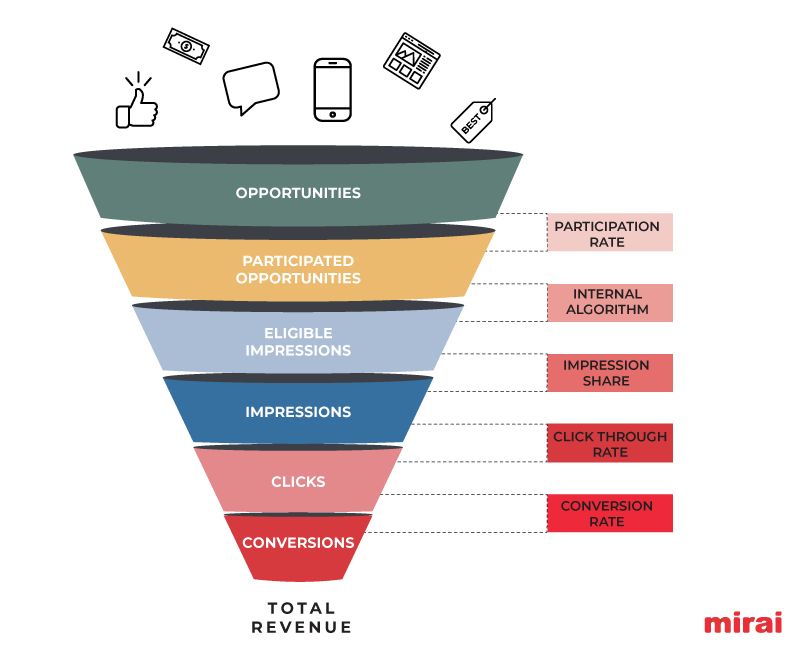

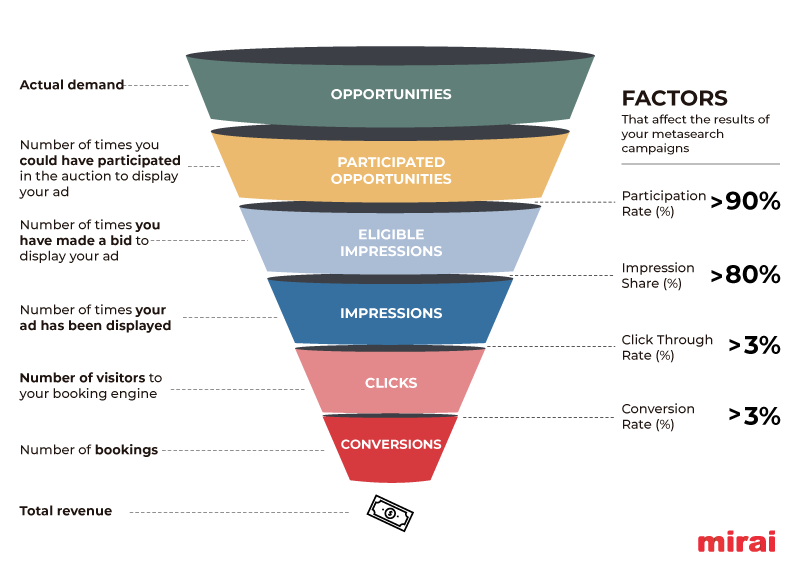

In this second post, we’d like to analyze the factors that affect each step in the funnel, the performance benchmarks you should aspire to, and how to identify areas for improvement and know what to do about them. Let’s remind ourselves first about the six levels in the Google metasearch funnel: opportunities, participated opportunities, eligible impressions, impressions, clicks and conversions.

Opportunities

Opportunities reflect the demand for your hotel in metasearch engines. They mainly depend on your strategy and positioning. Demand can be divided into two types:

- Branded search:

– Frequent customers who already know about you. The more you work on your customer loyalty, the more searches you will generate for your hotel.

– New customers who have learnt about you from some source or other, or who have been recommended your hotel. The better your hotel is positioned in the most important sites (OTAs, review sites such as Tripadvisor or travel blogs), the more users will search for you by name.

– Customers who search for you after having seen an online or offline marketing campaign. The greater the reach of your campaigns, the greater the demand for your hotel.

- Generic searches, generally by location or concept. These searches mainly depend on the popularity of the location of your hotel or its “theme” (“hotel with wine cellar”, “hotel with spa”, “hotel for kids”)

Participation Rate

Unlike demand, your participation rate mainly depends on your inventory management and the quality of the partner providing your site integration.

- Lack of room availability or stay restrictions. If you have no rooms available, or apply too many restrictions, such as a minimum length of stay, your participation rate will be lower and you’ll miss a lot of the demand that your hotel needs for certain dates. You’ll also suffer the impact of not being able to respond to requests for long stays (Google allows stays of up to 30 days) or stays that are booked well in advance (Google allows you to upload prices up to 330 days in advance).

- Ability to display prices for different numbers of guests. Many companies that offer metasearch integrations only show prices for searches for two people in a room, not allowing searches for three or four people or searches that include children. This is vital in resort hotels, where this type of search can be higher than 30% of total demand.

- Ability to differentiate flexible rates. Again, it’s the responsibility of your integration partner to provide the ability to differentiate non-refundable rates from flexible rates, so that Google can respond if users apply this type of filter in their search. If you don’t have this functionality, you’ll be missing out on all this potential demand and lowering your participation rate.

- Landing page relevance. Your integration partner has to be able to set up your campaigns to support as many different combinations of languages, currencies and other features as possible to be able to respond to user requests. Very often there are certain currencies and languages that are not available, meaning more potential demand is lost along the way.

A good participation rate is one that is above 90%. Below that means that you’re missing out on potential demand and leaving many great opportunities on the table. This untapped demand will go straight to the OTAs.

Impression Share

Impression Share is the percentage that results from the number of times that your ad or organic search result is shown to users compared to your total eligible impressions. What factors have a direct influence on your Impression Share?

- A competitive bid that gives you a chance to win the auction.

- Sufficient budget to allow continuity for your campaigns.

- A competitive room price, ideally better than the one offered by other bidders (OTAs). The more attractive your price, the less you have to bid to get visibility.

- The number of competitors bidding on your hotel. The more channels you have, the more competition there is. It’s the price you pay for “over-marketing” your hotel.

- The Price Accuracy Score (PAS) of your GHA integration partner in the Google Hotel Center account your hotel is in. The Price Accuracy Score measures any differences between the prices displayed in the metasearch engine and the prices in your own booking engine. A good PAS ensures better visibility in the free booking links and allows you to bid less for your paid ads to be displayed.

- Based on all these factors, that Google has a high degree of confidence that a user can click on your ad (Click-Through Rate).

Your Impression Share therefore depends on factors you control (such as prices, bids, budgets or the number of channels in which you appear) and factors that depend on your integration partner (Price Accuracy). All these factors influence your ad ranking, which determines their visibility.

A good Impression Share is one that is above 80%. If you score below that, you’ll have to rake a detailed look at how that percentage can be improved.

Click-Through Rate

The Impression Share gives you the number of impressions your prices receive in metasearch. But how many users actually click on your ads? That information is provided by the Click-Through Rate or CTR. What factors influence the CTR?

The position in which your ad is displayed (ranking) compared to other visible competitors. Higher positions get a higher CTR.

- Your price. This is the biggest factor in a price comparison site. There’s nothing better than having a better price than the OTAs to tempt users to lean towards you.

- The attractiveness of your ad. In this case we could include:

– Your hotel logo.

– Callouts or personalized messages.

– Photos of your rooms.

– The text used in the metadata of your integration (for example, the ones that explain flexible cancellation policies).

A good CTR is anything above 3%. If you have a lower CTR, you certainly have some room for improvement.

Conversion Rate

Once we have clicks and visits to your website, we need to understand the many and variable factors that influence your conversion rate. Above all, it depends on your distribution strategy, your booking engine quality and, to a lesser degree, the optimisation of your campaigns.

Distribution Strategy:

- That you have a worse price than OTAs, particularly Booking.com or Expedia. On the other hand, if you have a better price than them, your conversion rate will shoot up. You can choose to have a better price for different devices (mobile rates), different markets (geo-pricing) or for loyalty programme members.

Campaign optimisation:

- A correct understanding of audiences in your bidding will allow you to more precisely select users to target with your ads and thus improve conversion rates.

Booking engine:

- That your booking engine does not offer the same dates, occupancy, currency, tax information and cancellation policies that users have seen in the metasearch engine. This will lead to lower conversion rates.

- That you have poor content (descriptions and photos) in your booking process or lack certain languages.

- That the user experience and speed of your booking engine are not very good, especially when users are on mobile devices.

- That your booking engine is not integrated into your website but appears on a different page under a different domain with a different look & feel from your website.

- Forcing your customers to pay using a particular payment platform or trying to validate the credit card can have a negative impact on your conversion rate.

- Asking for too much information to close a booking, such as a personal ID or passport number, can deter users who intend to book but get lost along the way.

A good Conversion Rate is anything above 3%. If you have a lower rate, you should really take a look at what might be having a direct impact on your conversion.

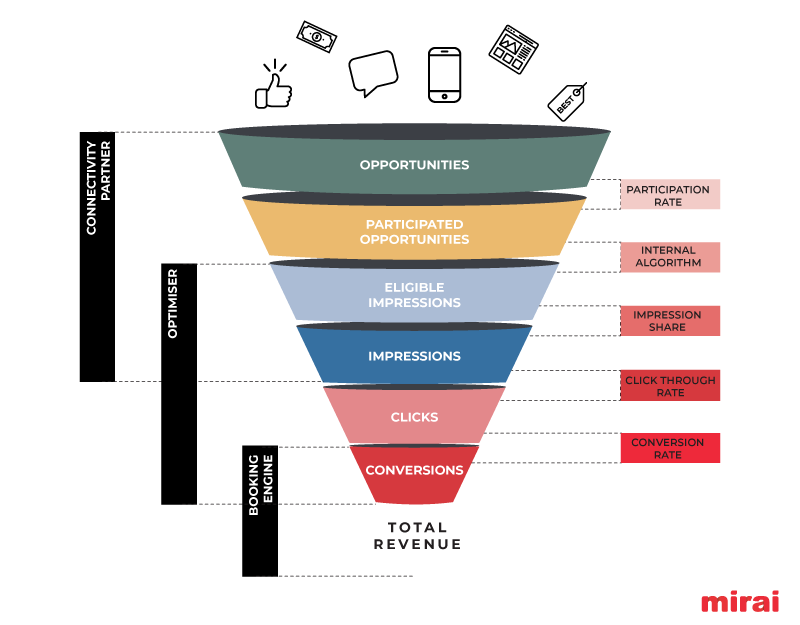

This diagram shows who or what is responsible for maximising results in each step in the funnel, the connectivity partner, the campaign optimizer or the booking engine. In certain cases it depends on more than one participant in the process for Google Hotels campaigns.

Compare your performance in each step in the funnel

Now is the time to get together all the data on your campaigns in the different stages of the funnel and quickly compare your results with the numbers we consider most appropriate for maximising your potential in metasearch engines. Maybe you’re doing well with some things and not so well with others. Remember that your total revenue is the result of the multiplication of each of the factors, meaning that even if only one of them is 50% below your target, you will be achieving only half of your potential revenue.

Conclusion

Once you know the six levels in the metasearch funnel, the most important KPIs for each level and the factors that affect those KPIs, you now have the full picture for diagnosing how good your metasearch strategy is, and what you have to do to maximize your results.

In many cases the solution will be to change the system you use for integration with metasearch engines. In others, it might be to change your booking engine. But there will also be others where what you need to do is change your direct sales strategy, addressing once and for all the issues you have, such as the price disparities with OTAs that are such a huge headache for the hotel industry.

About Mirai Metasearch

Mirai Metasearch connects your hotel to metasearch engines, making it more profitable than sales generated through OTAs. For more information, contact us at metasales@mirai.com

About Mirai Partnerships

If your company would like to benefit from our solutions, please contact us at partnerships@mirai.com

About Mirai Consulting

Our advice and support service for hotels that want to take their distribution and direct sales to the next level. More information at consulting@mirai.com