En español, en français, em português.

Designated as a “gatekeeper” by the EU, Google implemented the Digital Markets Act or DMA on 19 January 2024, a few weeks before the law came into force on 4 March 2024. Google Hotels had been growing consistently at an average of 14% in terms of both clicks and bookings to the direct channel, both in the EU and in the rest of the world. However, from 19 January onwards, the figures within the European Union slowed significantly and turned red up to -17%, resulting in a slightly higher than 30% diversion to markets outside the European Union. A major setback that leaves many questions unanswered. Where are the clicks and bookings going? Is Google Hotels losing metasearch share in Europe? Are other metasearch players such as trivago and Tripadvisor taking advantage of it? Are the OTAs the ultimate winners?

Google Hotels’ share of total direct bookings down 17% in the EU

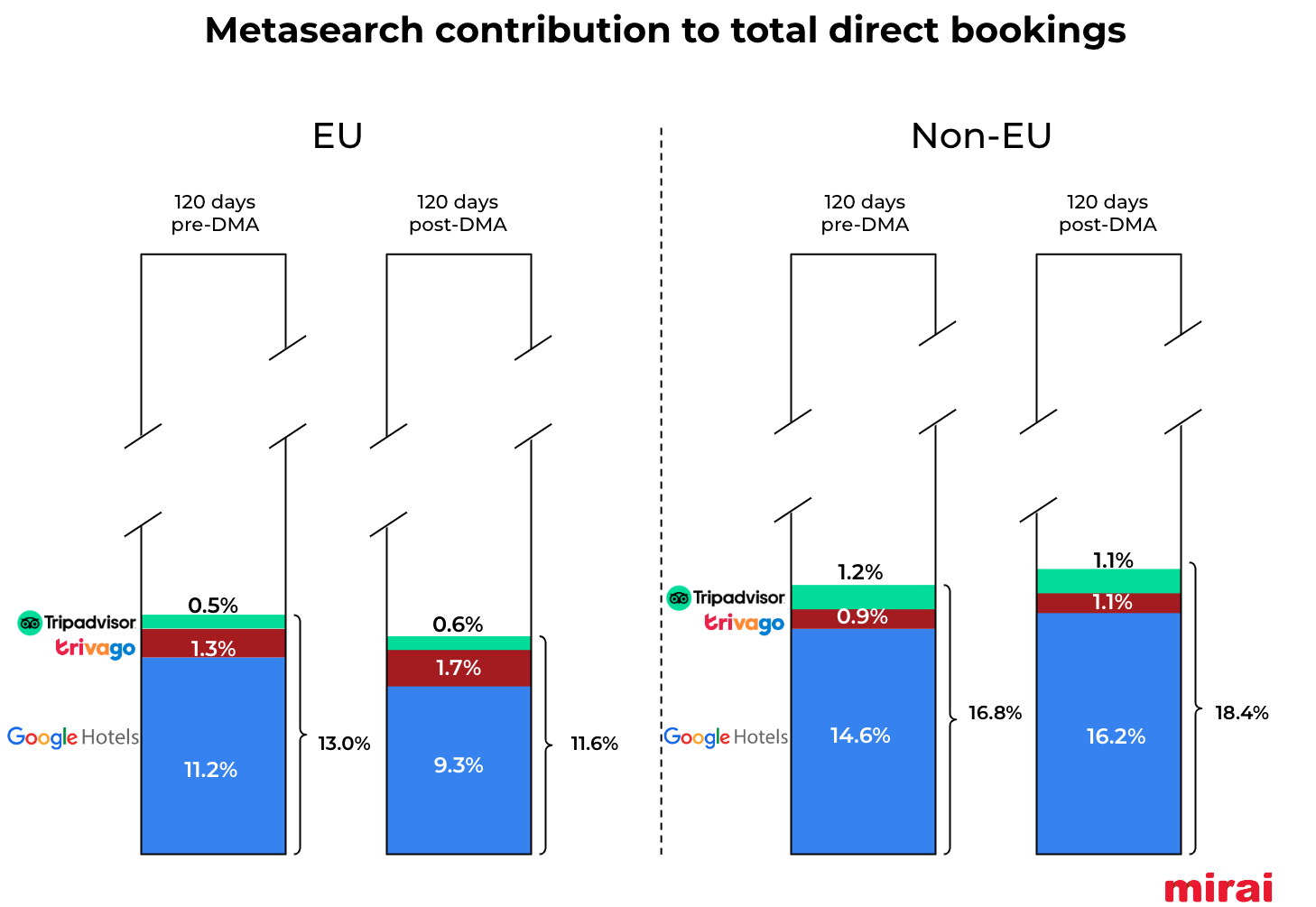

Metasearch has long established itself as a reliable source of traffic and bookings for hotels through its direct channel. Its contribution peaked at 24% of total bookings during the pandemic in 2021. With the new normal and various changes in the digital ecosystem, metasearch had lost some of its share but stabilized in the 14% to 16% range.

We compared the number of metasearch bookings 120 days before and 120 days after Google implemented the DMA on 19 January to see if there was a change. There was indeed a big one, with completely different trends in DMA and non-DMA markets.

- EU (DMA markets): While Google Hotels lost 17% of its share, trivago and Tripadvisor gained 36% and 6% respectively. Despite the growth of the latter two, metasearch as a whole lost 11% of its market share and now accounts for 11.3% of total direct hotel bookings in the EU.

- Non-EU (non-DMA markets): Google Hotels and trivago gained 14% and 11% share respectively. In contrast, Tripadvisor lost 13%. The overall metasearch share increased to 18.4%.

25% of EU bookings lost by Google were regained by trivago and Tripadvisor

In our study, trivago and Tripadvisor together gained 0.5% of bookings, while Google lost 2%. This leaves a net loss of 1.5%.

trivago’s bold growth of 36% and Tripadvisor’s positive 6% helped hotels mitigate the impact of the DMA in Google by winning back 0.5%, or 25% of the lost bookings. For those hotels not present on these metasearch platforms, it’s a good time to reconsider, especially now that both companies support a commission-based program (learn more about the trivago net CPA model and Tripadvisor CPA).

What happened to the other 75% of “lost bookings”?

Unfortunately, we don’t have any data on this. Only Google can answer that question. However, some guesses can be made. These are ours:

- Google Hotels is losing some traffic. Since it’s not very useful to compare rates at first glance, I wouldn’t be surprised if users are just playing around and looking for alternatives elsewhere.

- Other metasearch players are potential winners… and losers. The fact that trivago and Tripadvisor increased their share of bookings in EU in this timeframe suggests that users are looking for comparison tools before making a booking. For hotels, these bookings would still be direct, so not such a big deal here. It’s not all good news for these metasearch players. Don’t forget that they are also active bidders (known as “meta on meta”) in Google Hotels, so they are also likely to have a negative impact on traffic and bookings.

- OTAs are net winners. When looking for alternatives, users may naturally go from Google’s search results page to Booking.com and Expedia. Traffic that was previously captured and served directly by Google Hotels could end up in the OTAs, direct channels or other metas. Nevertheless, any traffic shift from Google Hotels to organic or paid is good news for the OTAs, who have been trying to reduce their reliance on metasearch tools for some time. For hotels, however, it is a worst-case scenario, as potential direct bookings may move to indirect channels at a higher cost.

- Other Google placements also sound like winners. We are talking about Ads, organically and Google Business Profile. For users who want to check the direct channel before making a booking, the fact that Google Hotels is no longer useful at first glance will not stop them. Users can easily find the link to the hotel website in Google, either in Ads, organically or directly in Google Business Profile. Therefore, other Google products may get some of the traffic that Google Hotels is losing. From the hotel’s perspective, this is not bad news, as the bookings would still be direct, although they could imply higher costs depending on the monetization strategy and CPC (auction) pressure.

Did hotels end up losing bookings? Has there been a shift from ‘direct’ to ‘indirect’?

I would not expect hotels to have lost any bookings. At the end of the day, demand hasn’t changed and consumers are still looking to travel and stay in hotels.

However, bookings may have slightly shifted channels, with a moderate risk that some direct bookings may have shifted to indirect or to OTAs. To what extent could this have happened? My guess would be an absolute number between 0.5% and 1.0% of total direct bookings. For hotels that sell 10% of their bookings online… that would be an impact of 5% to 10% of their total bookings. For hotels selling 20%, the figure would be between 2.5% and 5.0%. Whatever the final figure, it seems very likely that the DMA has actually benefited the major OTAs rather than the hotel industry.

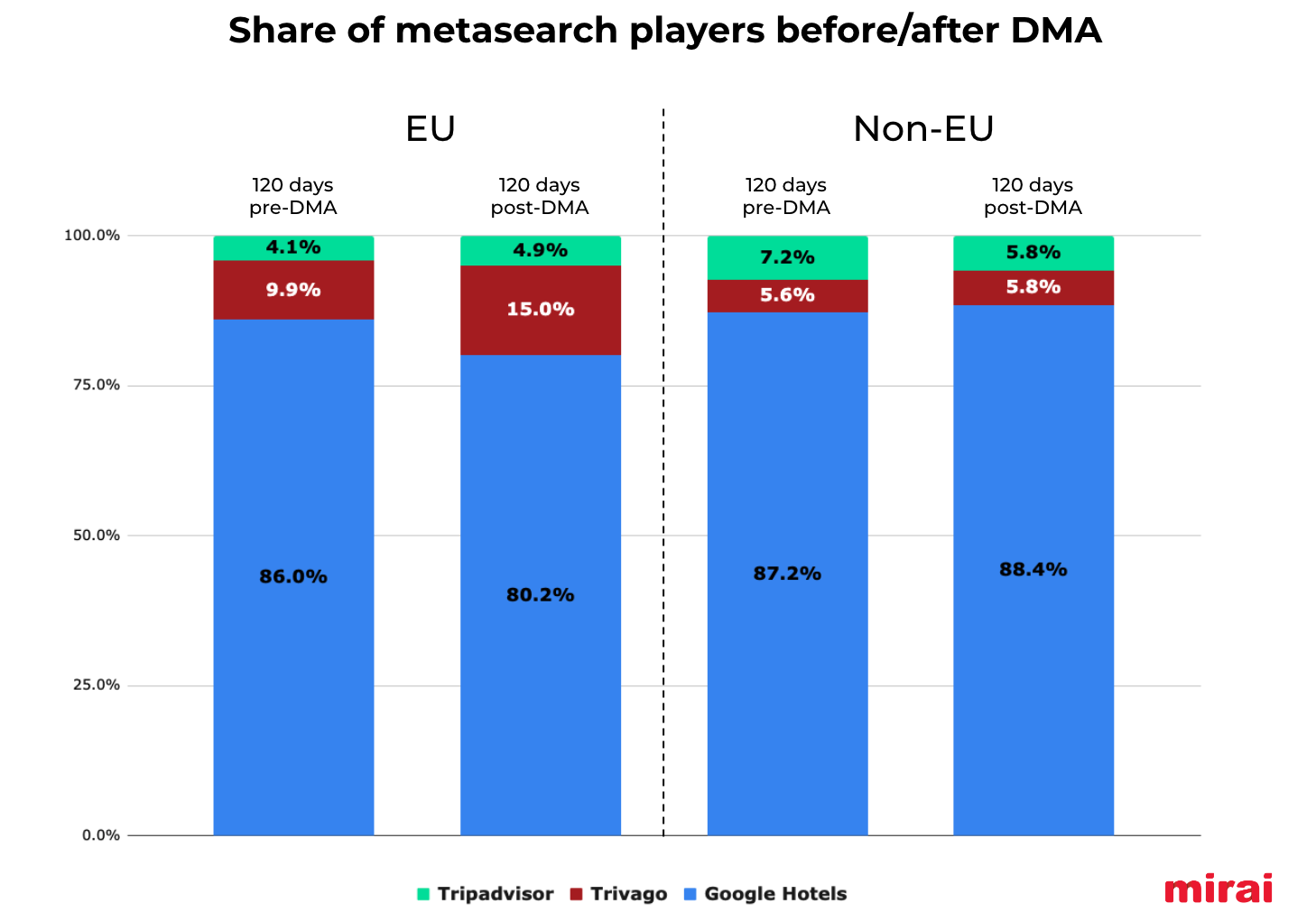

Despite DMA impact, Google Hotels remains the dominant metasearch in the EU

Despite the loss of visibility and functionality, Google Hotels remains the leader, generating more than 80% (down from 86%) of the total number of bookings coming from metasearch. trivago grows 5%, reaching 15% (its best performance in the last 5 years) and Tripadvisor reaches 5%. To simplify the study, we have excluded other metasearch players (they only account for 1%).

Google Hotels continues to rule outside the EU with an iron fist and 88% of the market.

Conclusion

It is somewhat paradoxical that a well-intentioned but clumsy EU law has ended up benefiting large US companies (Expedia and Booking Holdings) and negatively impacting the hotel industry within the European Union. While we wait (and hope) that regulators will eventually change the law or that Google will be smart enough to restore its meta functionality, hotels are left alone to make their own decisions to minimize the impact of the DMA. Participating in other metasearch players, investing in Google Ads, and making sure your Google Business Profile and organic listings are optimized are some alternatives.

Meanwhile, the EU has just ratified Booking.com’s self-gatekeeper designation on May 13. The OTA now has six months (until Nov 13) to fully implement the DMA. It’s yet to be seen what changes will come, but we could see interesting opportunities for hotels to fish in Booking’s exclusive and private pond. We will have to wait and see. Stay tuned for more updates from Mirai.