En español, en français, em português.

Traditionally, hotels have “embraced” OTA’s as the only real way of accessing the huge market of potential clients who are looking for a hotel in their destination. This is because of OTA’s efficiency and the large volumes they can handle. Hotels can barely access this “new demand” unless they use OTA’s or other intermediaries. This circumstance has led hotels to depend excessively on intermediation, which in turn leads to a loss of profitability.

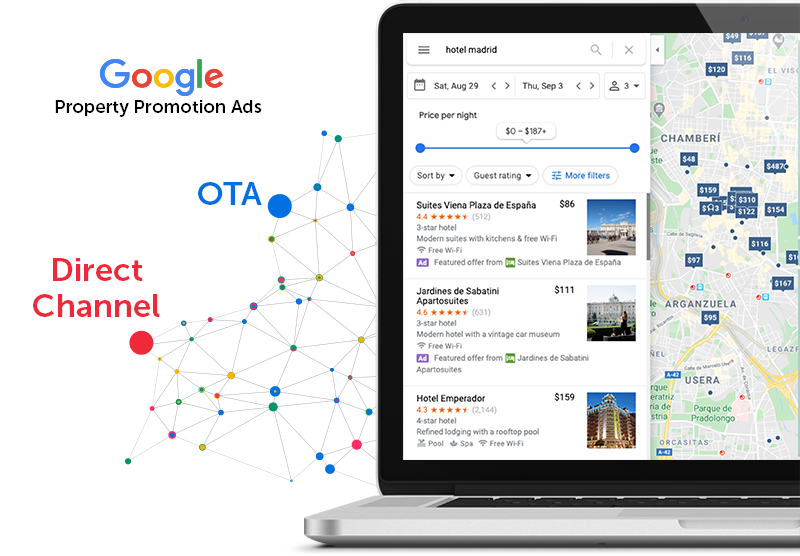

With its latest feature – Property Promotion Ads or PPA –, Google is about to change the rules of the game and offer hotel owners and their direct sales channels a viable alternative to gain visibility in a field traditionally occupied almost exclusively by OTA’s.

New demand vs current demand

Digital distribution requires a good understanding of and a strategy to address:

- “New demand”, or clients who are looking for a hotel in a destination (“hotel in Barcelona”) or by concept (“family hotel near Valencia”). “New demand” is highly valuable for your hotel and attracting it should be your number one priority. What could possibly be better than to get a client who does not know you to stay at your hotel? New clients are “gold”, especially if you manage to retain them.

- “Current demand”, or clients who search for your hotel by name or brand (“hotel Samos in Mallorca”). In this case, the difficult part is behind you. These clients are already interested enough to search for you, whereby we can assume that “they will most likely end up staying at your hotel.” In this case, what is at stake is the channel they will use to book their stay (“will they book on Booking.com or on your website?”).

OTA’s “across-the-board” deal to cover all types of demand

What OTA’s offer is crystal clear: they charge you a commission for the total amount of sales they provide, regardless of whether these are from “new demand” or “current demand”. It could not be simpler. That is partly the key to their success.

As a hotel, you tend to think in positive terms and about “all the new demand they’ll provide” which, with commissions of about 20%, works out rather well. At the end of the day, these are clients who do not know you. You would happily pay even more.

But you do not often stop to think about the fact that OTA’s are charging you the same commission for the “current demand” that will reach you through them and that, by the way, is much higher than you think (at Mirai we estimate it is about 50% of the total). OTA’s usually pepper their discourse with concepts like “new sales” and “visibility”, which sound very good, but they do not often openly tell you that they will do everything in their power to attract customers who are searching your name, be it with Ads for your brand or bidding on your name on metasearch engines. Below is an example of OTA fees using said model:

How much should you be willing to pay to attract “new” customers as opposed to “current” ones?

Attracting “new demand” is not easy, and yet it is essential; you cannot live off of repeating clients (even more so if you own new hotels, where you do not have any to start with). Given their high value, in theory you should be willing to pay more for these clients who do not know you. But how much more? It depends. How much would you pay to fill a room that would otherwise be empty during low or middle season? And during high season, when you will foreseeably be fully booked, although a higher demand would help boost your prices? The answer is not the same for everyone and it depends on the “repetition rate”.

If you are able to turn a new client into a repeating one, the cost of attracting that first booking will dilute the more times said client repeats his stay (this is known as “customer lifetime value”). Large hotel chains have this all figured out and they are willing in some cases to pay 100% during low season (the room is vacant anyway) as they know that client will return 3 times over the following X years (“if I attract a client for 100% of the cost the first time but retain the following three at 5%, it works out at an average of 27% and dropping”). For hotels who do not manage to get these new clients to repeat their stays, these amounts cannot be assumed, and in future they would not be able to handle costs above 20%.

On the other hand, “current demand” should be much cheaper (and profitable) to attract. You can do it paying less than 6-8% by always bidding on your name or brand. Your limit is set by the OTA’s, with average commissions of about 18-20%. If your campaigns are above this limit, it might work out better if those sales reached you through OTA’s. The intangible values (which are many) of direct sales over intermediated ones are another story.

The direct channel and the struggle to access new demand

Hotels have historically struggled to access “new demand” through their direct channels. At Mirai we have always said that direct sales, with some exceptions, are not incremental; they channel current sales (that arrive though other online channels such as OTA’s or B2B affiliates). You only have to see what keywords bring users to your website to realise that more than 90% of them are looking for your hotel by name or brand.

There are several strategies for attracting “new demand” using your direct channel, such as SEO (which has lately been called into question) or generic Ads campaigns. You also have Display and Paid Social. These models are based on the CPC or cost-per-click model (or even CPM or cost-per-mille) and their profitability is not what most hotels would like (costs of 50% or more in several cases) because, as we’ve just seen, capturing new sales is not cheap —and understandably so. Therefore, hotels do not usually contemplate this line of advertising and focus almost exclusively on the demand for their name.

Google’s alternatives for each type of demand

- “Current demand”. When a client searches for your hotel by name (and there is only one possible result), Google presents your My Business profile alongside the results with a link to your website, as well as the Hotel Ads module, Google’s tool for addressing this type of demand.

- “New demand”. This type of demand comes from a higher stratum of the funnel, and to access it Google now brings us its new version of Property Promotion Ads or PPA (formerly known as Promoted Hotels), thanks to which hotels will be able to address these users and redirect them to their direct channels. A significant breakthrough in a field so far almost exclusively controlled by OTA’s.

Both Hotel Ads and Property Promotion Ads can be controlled from Google Ads as independent campaigns, each with their own bidding strategy. You can separate the cost of attracting “new sales” (and pay more) from the cost of attracting “current sales” (and pay less), which is impossible through OTA’s. Using the same example as earlier, if we pay a commission of 30% to attract “new sales” we would end up paying the same total cost as when we use OTA’s. But many hotels dismiss these costs as too expensive (even though they are already paying them through OTA’s).

Now, let us imagine you can engage that “new demand” for less than 30%, let us say about 12%. In this scenario, for every 100€ we make through direct sales instead of through OTA’s, we would save up 6€ (that is 6% more than if we made them through OTA’s). Sounds interesting, right?

Google Property Promotion Ads: an alternative to OTA’s for greater visibility

Property Promotion Ads provide an alternative to OTA’s for attracting “new demand”, the big unresolved issue of direct sales channels. What is more, this alternative is backed up with images (a feature Ads have so far never decided to go forward with), making your advert a lot more attractive.

But the real novelty is not only the fact that you can access this new demand; it is also the how. As we have seen, all the available alternatives for attracting “new demand” rely on a CPC model, which makes it difficult to obtain affordable profits. Property Promotion Ads have put an end to this and are now offer the following types of bidding:

- The classic CPC or “cost per click”.

- Two commission-based systems than can be applied in different moments:

- Commission (per conversion) or Pay per Conversion. A fee that can be applied, and paid, at the time of booking, regardless of whether the booking is cancelled afterwards. Google’s former CPA.

- Commission (per stay) or Pay per Stay, formerly referred to by Google as GHACP (Google Hotel Ads Commission Program). A net cancellation fee, payable after the client’s stay. It is the most similar to an OTA commission.

The chance to run campaigns to attract “new demand” with a commissionable model, be it per stay or per conversion, is nothing short of revolutionary because:

- It guarantees a certain profit, which had been impossible so far because of the reign of the CPC model.

- It is good for your cash flow (using the Commission per Stay) model, a crucial point for many hotels, especially seasonal ones.

- It solves traditional budgeting problems that arose from the use of CPC campaigns. The more you sell with a guaranteed profit, the better.

- It is a perfect match for hotels’ commission-per-stay philosophy, so you do not need permission from your sales manager or finance manager to kick off campaigns. For most hotels, a commission is a commercialisation expense and a CPC is a marketing expense (this idea is wrong, but it happens quite often).

The importance of controlling the bid for “date of stay” and “type of demand”

As we have mentioned earlier, the simplicity of the OTA model belies the presence of a little “trap”, namely that they charge the same for “new demand” and “current demand”. But there is yet another “trap” (for you, not OTA’s) and that is overrides.

- You choose it to “gain visibility and access more new demand.”

- You usually use it on low-demand dates or because of sudden cancellations.

- All the sales you make during those dates will have an attached commission (let us say 25% instead of 20%), even the sales you would have made anyway.

- Should not this commission only apply to additional sales? In theory, but it does not work that way. Let us take a look at an example of how OTA’s spin gold out of this. A hotel pays 18% and overrides 25% to “gain visibility.” The commission the hotel ends up paying for that new sale ranges from 32% to 95%. Would you be willing to pay these commissions for new sales made through your website?

Google once more breaks this association by letting you pay a different commission exclusively for additional sales. You could create a campaign at 25% to “gain visibility” targeting only cell phones in the UK market and for stays in September. Only this campaign would cost 25%, while the rest of your campaigns would remain at 18%. If we apply this to the previous example of OTA’s, the amount of money you end up saving is substantial.

Sadly, so far Google has only provided the “Booking Window” multiplier, which marks how long the consultation is done in advance. This means you can vary your bid for consultations done X days in advance. While this is well-intentioned, this “lever” is still limited and insufficient for many hotel owners who would like greater control over the dates of stay to modify their bids accordingly.

Let us hope Google will further develop this feature in a way that will provide hotels greater control over specific dates of stay on which to mould their Property Promotion Ads campaigns. Only this way, when you face low-demand dates or sudden cancellations, will you have the alternative to start overriding on Property Promotion Ads and pay more only for new sales, instead of doing it through OTA’s and paying more for all of them.

Direct sales, not Google, are a threat to OTA’s

To say that Google is a threat to OTA’s would be wrong. Google has simply enabled a necessary change for the distribution of any given product and that is giving the owner (the “hotel” owner, in this case) the opportunity to access and sell directly on the market.

Any change that helps hotels bring both ends together is a direct threat to intermediaries.

Google per se is not a threat to OTA’s. What is more, everything it does is available for direct sales and intermediaries alike (with some exceptions, such as the commissions-per-stay model). Direct sales are the real threat to OTA’s. If hotels understand and take advantage of the potential of Property Promotion Ads to boost their direct sales, OTA’s will be under threat.

Conclusion

With Property Promotion Ads, Google continues to build a powerful advertising system that perfectly combines several complementary products: the aforementioned Ads, Hotel Ads and, from now on, PPA, to cover different needs in different parts of the funnel. And all in a single platform. Smart move.

For hotels and their direct channels, this opens up a world of opportunities where they can compete with OTA’s both for “current demand” and now also for “new demand” using a risk-free model (commission per stay) and by date of stay. Heretofore, this was exclusively OTA territory. Will you take advantage of this opportunity to try, test and evaluate it for yourself? If you do not do it with your direct sales, you can take for granted that the OTA’s will do it for you and, what is worse, with your money.

All Mirai clients on the Commission Program or GHACP (the new Commission per Stay) can already use Property Promotion Ads with the same commission model.

Here you can learn more about boosting your direct sales channel in metasearch engines. You can also contact us at metasales@mirai.com.