In some countries – Colombia, Peru, Argentina, Ecuador… – foreigners staying in hotels are exempt from tax (VAT or equivalent). However, the opposite could also be the case, i.e. nationals may be exempt. If either of these cases applies to you, you can benefit from this functionality in Mirai’s booking engine, which now supports distinction of any tax application according to the customer’s nationality. You will also benefit from the following:

- Your direct sales will be far more competitive for customers from exempt countries. The percentages involved here are relevant: 15%, 20%… which can mean significant price reductions.

- You will gain clarity: you will avoid misunderstandings, as the price the customer will be offered and which will be confirmed will be the same as that paid at the hotel.

- Your presence on metasearch engines will improve, as these support different prices and taxes depending on the nationality of the user. The user will be notified in each case.

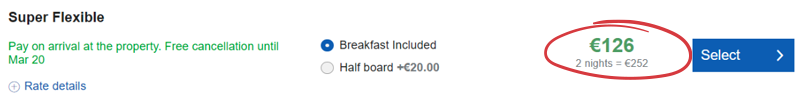

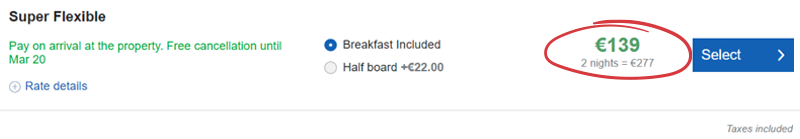

So, the same hotel may display different prices, for example…

To a customer from the USA:

To a national of the country where the hotel is located:

If this is the situation with your hotel, you don’t have to do anything. Your account manager will have already set up everything you need to benefit from this upgrade. In any case, he or she will be happy to answer any questions you may have.

If this is the situation with your hotel, you don’t have to do anything. Your account manager will have already set up everything you need to benefit from this upgrade. In any case, he or she will be happy to answer any questions you may have.